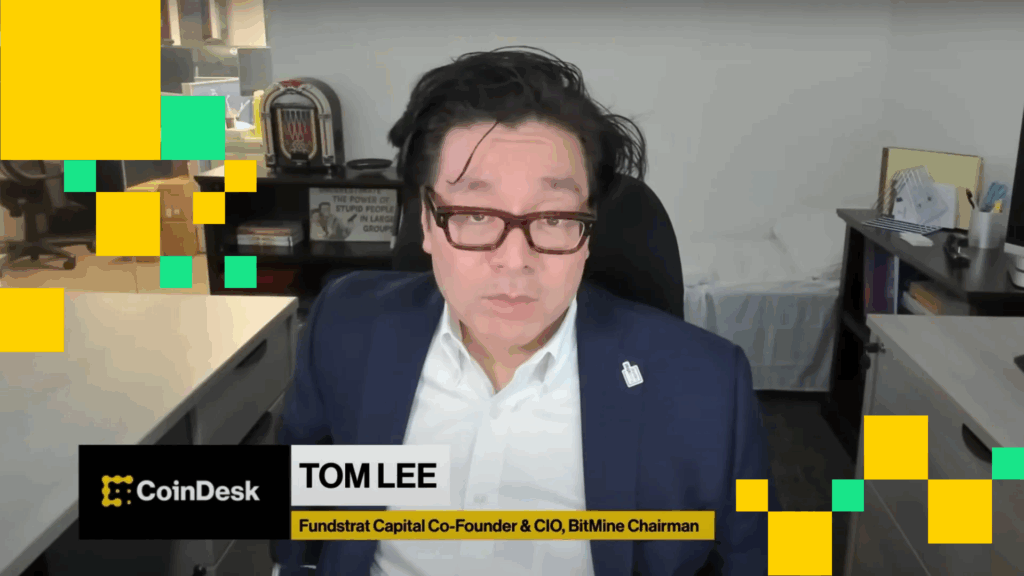

Bitmine immersion technologies (BMNR)The Digital Asset Treasury Company focused on the ethereum ether (Eth) And directed by Tom Lee de Fundstrat, he said that his Crypto, Cash and Capital holdings reached $ 10.77 billion.

Until Sunday, the Las Vegas firm was 2,151,676 ETH, adding 82,233 tokens to its stash last week, according to a press release from Monday. It also had $ 569 million in cash without gravation. The ether has a value of $ 9.7 billion at current prices.

His capital participation in Ochoco focused on the world (Octo)A new cryptographic treasure company focused on the Iris Worldcoin scan project It rose to $ 214 million. That is more than 10 times the initial investment of $ 20 million, marking Bitmine’s first bet on a digital assets treasury partner, which calls “lunar shots.”

From the pivot of the firm to Ether in June, Bitmine has become the second largest corporate public owner of a cryptocurrency, just following Bitcoin’s stash of $ 73 billion of the pioneer strategy.

Treasury companies have been under pressure in recent weeks with some actions that quote below the value of the net assets of their underlying holdings. The rival company Ethereum Treasury Sharplink Gaming, for example, last week bought the capital to raise the price of its shares.

Read more: the purchase of corporate bitcoin was slowed in August, since the treasure bonds add $ 5b