Ether (eth)

He published a modest recovery on Saturday after a volatile week marked by huge institutional departures. On Friday, June 20, Spot Eth Ethf that listed in the United States registered $ 11.3 million in net departures, the largest decrease in a single day in June, according to data from Farside investors.

The setback was led by the ETF ETF of Blackrock, which saw an exit of $ 19.7 million, its first and only negative flow this month. On the contrary, Groyscale’s Ethe product attracted $ 6.6 million, and Vaneck’s ETF ETF Ethv added $ 1.8 million, partially taking off losses. No other issuer registered tickets or exits.

The data suggests that large institutions may be reducing their exposure to ETH, even when selected funds such as the gray scale continue to attract capital.

The ETF flow figures emerged along with a technical rebound in the price. Ether briefly fell to $ 2,372.85 on Friday in a large sale of sales marked by a volume increase almost five times the daily average, but quickly recovered as the buyers intervened around the range of $ 2,420– $ 2,430, according to the technical analysis model of Coindesk Research. Since then, this area has formed a solid support zone, validated by multiple low volume tests, which suggests accumulation.

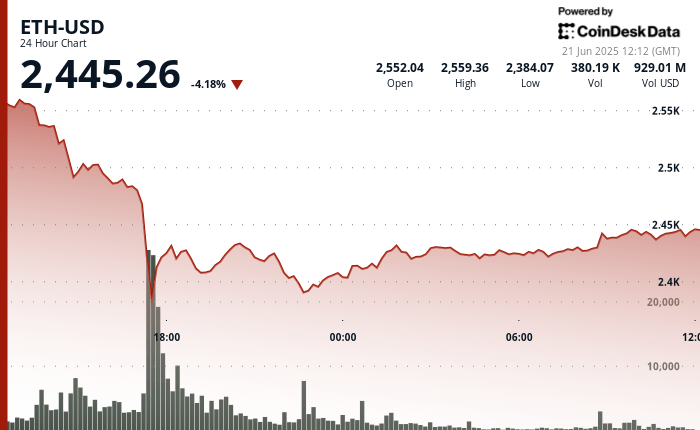

The 24 -hour negotiation volume increased by 18.97% above the 7 -day mobile average, reflecting the high commercial interest during price recovery. ETH closed about $ 2,445 and formed an ascending line of higher minimum trend, although the key resistance remains at the level of $ 2,480– $ 2,500.

TECHNICAL ANALYSIS

- ETH-USD registered a 24-hour negotiation range of $ 186.44 (7.25%), with a strong sale of $ 2,372.85 that marks the decline.

- The fall occurred during 5:00 p.m. and was accompanied by an acute hole in the negotiation volume, reaching 993,622 units, almost 5 times the daily average.

- A key support zone formed between $ 2,420 and $ 2,430, reinforced by multiple successful reestimations with a progressively lower sales volume.

- ETH recovered 38.2% of the fibonacci setback from the mass sale and built an ascending line of ascended by minimum higher.

- During 08: 00–09: 00 hour, the volume accelerated again, pointing out the upward impulse and the elevation price towards the level of $ 2,445.

- In the last hour, ETH quoted in a narrow band of $ 5.83, ranging between $ 2,440.14 to a closure of $ 2,443.45.

- A late session rally reached its maximum point at $ 2,447.02 (11:38), with an intra-salary explosion of 4,532 units.

- The price then fell slightly but found an immediate support at $ 2,439.38, and continued to respect the ascending short term trend line.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.