Validators in the BNB chain have proposed to reduce the minimum gas price from 0.1 GWEI to 0.05 GWEI while reducing block intervals of 750 milliseconds to 450 milliseconds.

The objective is to reduce the average transaction costs to around $ 0.005, which makes the network competitive with low -cost chains as a sun and base.

The proposal follows a decision in April 2024 to reduce the 3 GWEI gas to 1 GWEI, and again in May it was reduced to 0.1 GWEI, with rates that fell by 75% as a result.

“While the beekeeping of the reference remains above 0.5%, the BNB chain should strive to have the lowest possible gas rates,” says the proposal, framing ultra -low costs as a central principle of network growth.

The moment of the proposal is key; Commercial activity in the chain is booming with an aster of decentralized exchange that emerges as the place of negotiation.

According to Coinmarketcap, the exchange processed $ 29.37 billion in volume of perpetual futures in the last 24 hours. Defillama data show that Aster generated $ 7.2 million in daily revenues, more than double $ 2.79 million of hyperlycides.

That force is reflected in its chips. Ast has increased 37% in the last 24 hours, raising its market capitalization of $ 931 million a week ago to $ 3.74 billion. On the contrary, Hype has thrown billions in value, falling from $ 14.88 billion to $ 11.73 billion.

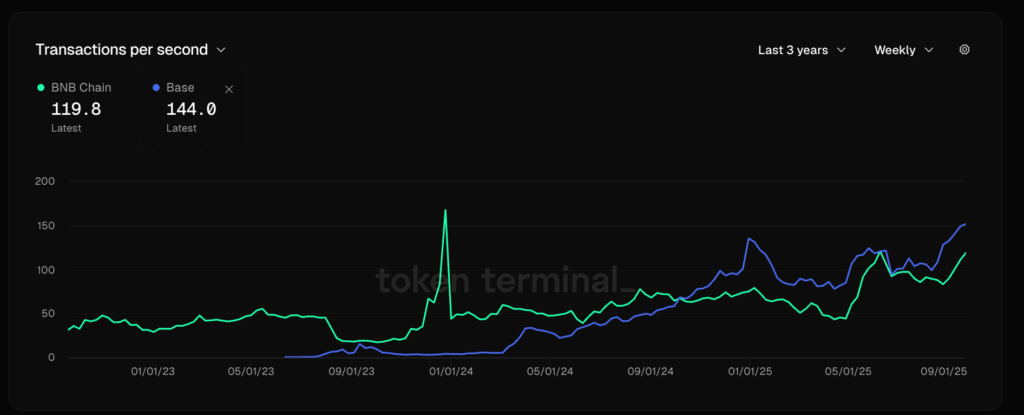

Trade related transactions already dominate the activity of the BNB chain, which increases from 20% to the beginning of 2025 to 67% in June. The proposal indicates that a lower cost environment could boost greater growth.

Meanwhile, BNB Token has decreased by 1% in the last 24 hours, but still remains above a key psychological level of $ 1,000 with a daily volume that exceeds $ 3.8 billion.