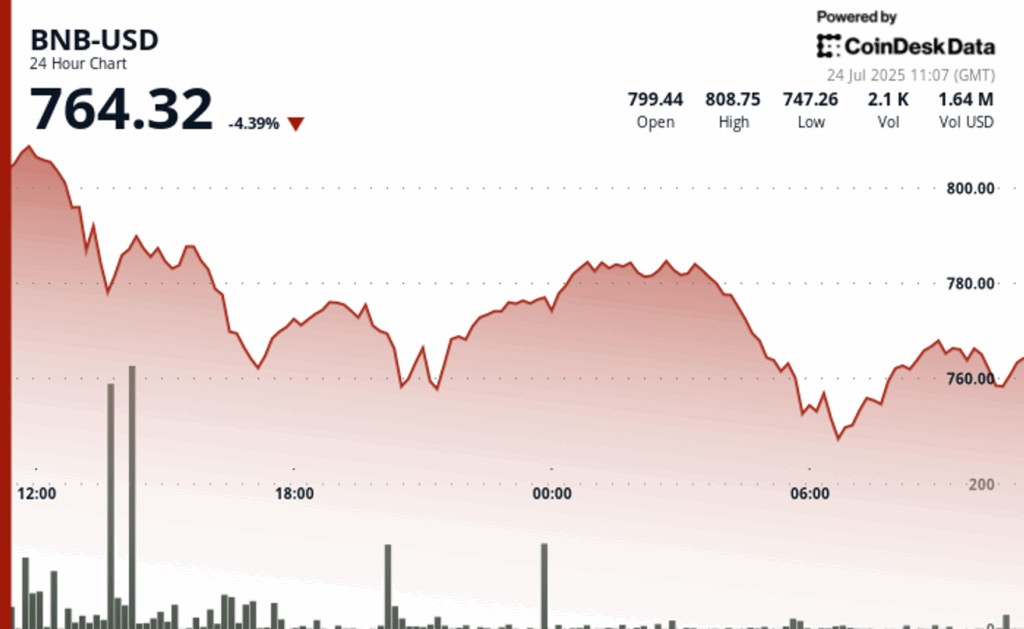

BNB slipped 4.3% in the last 24 hours, falling from $ 808 to $ 764 in a strong setback that erased a part of its monthly profits.

The fall occurred in a heavy volume, and the merchants observed a critical support zone of around $ 744 to $ 753 as the next test for the market.

At one point, BNB touched a minimum of 24 hours of $ 744.56 and briefly recovered to $ 759.35. The movement suggests that merchants may be consolidating near these levels, although the price action continues to form higher in a sign than the bearish trend remains intact, according to the technical analysis model of Cindensk Research.

The price has continued to slide during the negotiation session, reinforcing concerns about continuous sales pressure. The $ 744 floor is observed to see if Holds or Breaks, which could prepare the stage for an additional decrease.

BNB has had a lower performance of the wider cryptographic market in the last 24 hours, since the Coindesk 20 (CD20) index has fallen 3.6% during the same period.

The setback follows a strong demonstration that led BNB to a record of $ 804 on July 23. The Nano Labs, quoted in Nasdaq, acquired $ 90 million in BNB recently, while companies like Build & Build Corp. and Windtree are also accumulating.

In social networks, the founder and former CEO of Binance, Changpeng Zhao, commented on the recent performance of cryptocurrency, showing appreciation by ecosystem participants.

Even so, the sale of the sale of merchants is now obtaining profits or repositioning in the midst of a broader increase in the Altcoin trade volume and network updates in the BNB chain.