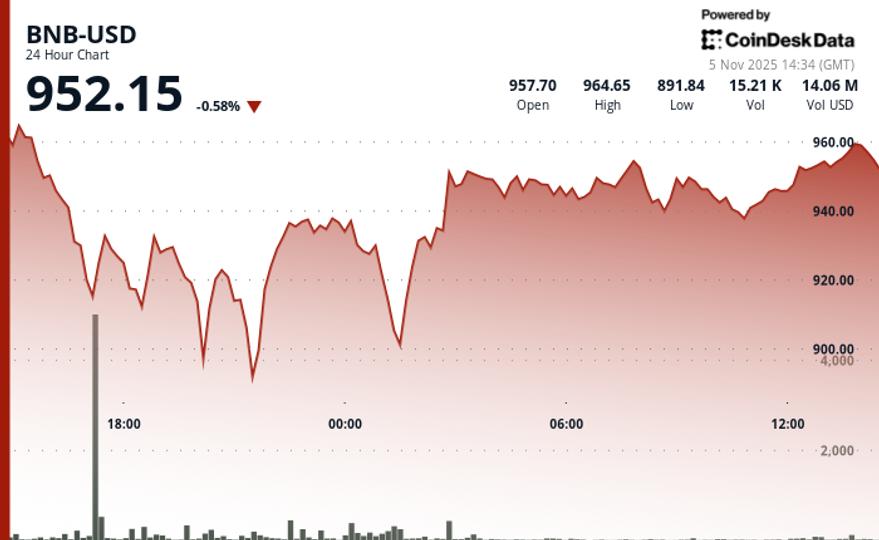

BNB Chain’s native token BNB remained stable above $950 after falling 0.6% in 24 hours. The token was last trading at $952, showing resilience in the face of broader market volatility; The CoinDesk 20 Index (CD20) fell 1.6% in the same period.

After opening at $957.70, BNB fell to a low of $891.84 before recovering. Buyers stepped in at the $940 support level, an area that had been tested repeatedly during recent price swings according to CoinDesk Research’s technical analysis data model.

The rally suggests that traders are selectively accumulating BNB while much of the crypto market remains flat or under pressure.

Trading volume over the past 24 hours stood at $14.06 million, around 86% of the weekly average, pointing to continued interest with no signs of speculative excess.

The price has now broken above the $944 resistance zone, with $950 emerging as a key psychological level for the next bullish leg.

Behind the price action there are structural factors. The regular burning of tokens on a quarterly basis and the expansion of usage within the BNB chain ecosystem continues to support investor confidence.

About 67% of the BNB supply is held by public investors, and less than 1% is controlled by insiders, reducing the risk of large sudden liquidations. This is according to a recent report from Binance co-founder Changpeng Zhao’s family office, YZi Labs.

If the momentum holds, there is upside potential towards the $1,230 to $1,300 range.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk’s full AI policy.