Binance’s token bnb rose on Tuesday to the back of the United States Stock Exchange and Securities Commission by dismissing its long -term demand against cryptography exchange last week.

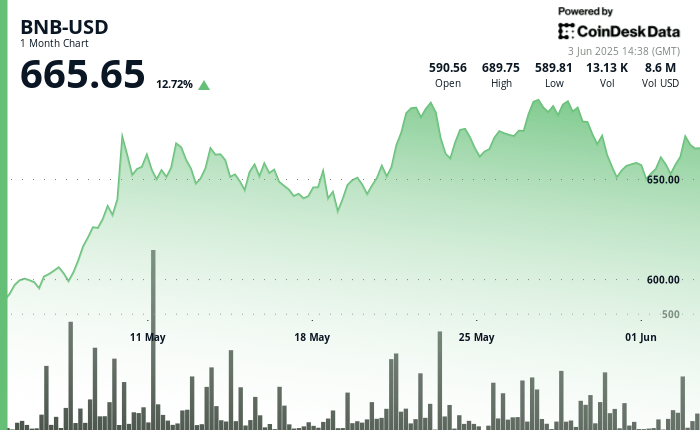

The Token increased from $ 650.28 to $ 673.70, an increase of 3.6%, before entering a period of lateral trade and a brief correction that saw him return to the level of $ 665.

The SEC movement comes at a time when the exchange brought the US dollar deposit characteristics previously restricted, including Banks ACH transfers, which marks a partial restoration of the Fiat channels of Binance on its US platform.

The moment added fuel to the BNB rally, which occurred in the midst of a broader global financial restlessness, including changing commercial policy and the increase in macroeconomic uncertainty.

Meanwhile, the data in the chain showed that the BNB chain was driving $ 14 billion in daily decentralized exchange volume (DEX), surpassing Ethereum and Solana combined. This activity scale suggests that the BNB chain remains a crucial place for cryptographic trade despite regulatory scrutiny.

General description of the technical analysis

- On the technical side, BNB showed solid accumulation patterns, according to the technical analysis data model of Coindesk Research.

- The price of the action formed an ascending channel, briefly reaching about $ 673.70 before withdrawing to consolidate above the psychologically important level of $ 665.

- An increase in acute volume around 01:00 and the renewed purchase of about $ 665.32 helped stabilize the price of Token, indicating the buyer’s interest at those levels.

- If the support continues to have, merchants can interpret the movement as the beginning of a longer bullish trend, especially now that some regulatory cantilever has been raised.