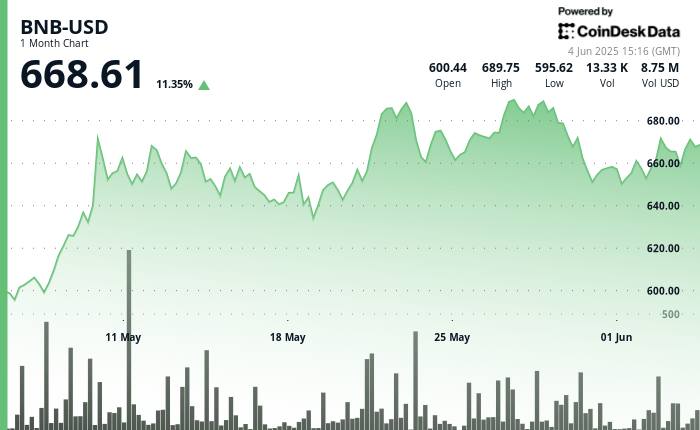

BNB remains stable of around $ 668 as the positive developments in their ecosystem find regulatory voltage and broader market volatility.

Token has won more than 11% in the last month, helped by a strong decentralized financial activity and the end of the long -term demand of the United States Securities and Securities Commission against Binance.

The repression of Binance against the bots exploiting its Alfa Points Reward system has highlighted exchange controls, probably promoting investor confidence. Users depended on automation to the farm points to ensure additional rewards.

Alpha Points helped boost a new activity of the BNB chain, which brings decentralized exchange negotiation volumes (DEX) up to $ 187 billion in May, giving the network a market share of 36% according to Dune Analytics.

The increase in automated activity threatened to erode confidence in system equity.

At the same time, Pancakeswap, the flagship decentralized exchange of the BNB chain, obtained $ 6.72 million in the last 24 hours, according to defillama. The figure places it above the circle of $ 6.35 million, the issuer of the second largest USDC of Stablecoin who is looking at an opi to an assessment of $ 7.2 billion, brought during the same period.

The BNB chain itself registered an increase in the activity in May, processing 198 million transactions, 148% more than the previous month and surpassing Ethereum in the transferred value, as Dune’s data show.

The BNB price action has been maintained technique, with a support that forms about $ 663 and resistance about $ 691, according to the technical analysis data model of Coindesk Research.

A rupture could bring prices to $ 790, although any fall below $ 648 runs the risk of a correction, according to the model.

Discharge of responsibility: parts of this article were generated with the assistance of the AI tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy.