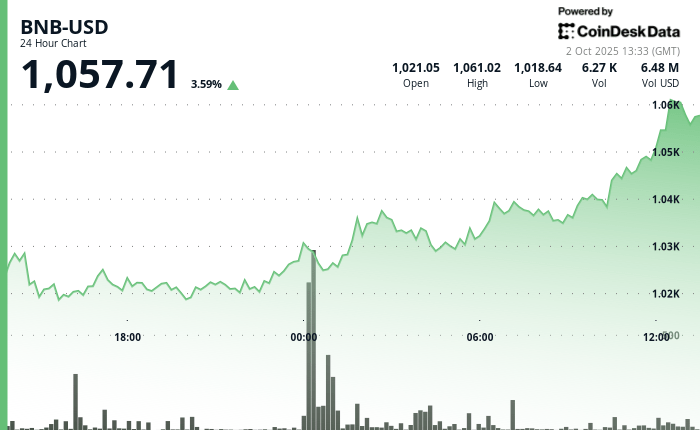

BNB recovered more than 3.5% in the last 24 hours, tracking wider profits throughout the cryptographic market as expectations of a federal reserve rates.

The token increased from a minimum of $ 1,017.44 to more than $ 1,050, marking a break above the key resistance levels in the session. The increase is produced to the back of an unexpected fall in the private payrolls of the USA that adds to a growing list of signals that the Fed can begin to facilitate monetary policy before expected.

With the data of official jobs arrested due to the ongoing closure of the US government, the merchants have strongly supported the weak ADP report, which showed a loss of work of 32,000 in September against the expectations of a gain. Derivative markets now have a price close to a reduction of 25 basic points at the end of this month.

BNB’s price action reflected that change of feeling. After submerging in the middle of the session, the Token bounced at the support level of $ 1,020 and constantly rose to the closure, driven by the volume that exceeded the average of 24 hours, according to the technical analysis data model of Coindesk Research.

Merchants pushed BNB to the resistance of $ 1,035 in the rally, which saw the broader cryptographic market increase 2.25%, as measured by the Coindesk 20 index (CD20).

The higher market performance of the widest market reflects specific tokens catalysts. Earlier this week, the BNB chain reduced its minimum gas rate at 0.05 GWEI, which makes the network one of the cheapest among the main block chains.

Meanwhile, the Alem Crypto Fund of Kazakhstan backed by the State appointed BNB as its first investment asset. The objective of the fund is to build long -term reservations of digital assets and signals that increase adoption at the sovereign level.

BNB also resisted a brief safety incident during the session when the BNB chain X was committed. The computer pirates left with approximately $ 13,000 before the problem was resolved and the community recovered behind it.

Discharge of responsibility: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy.