Binance Coin (BNB) rose in the last 24 hours, even when geopolitical tensions shook the markets, driven by the increased use of the BNB chain, which recorded more than 16 million transactions last day earlier this month.

That transaction figure marks a mass jump when from the nearly 4 million transactions per day prosecuted at the beginning of the year, according to Nansen’s data.

Pancakeswap, the main decentralized exchange of the network, played a key role with $ 2.7 billion in daily volume. Together, BSC managed more than $ 104 billion in volume DEX during the last month, surpassing Solana and Ethereum, according to Data Data.

This growth helped BNB boost the volatility caused by clashes between Israel and Iran, which temporarily dragged Bitcoin below $ 104,000.

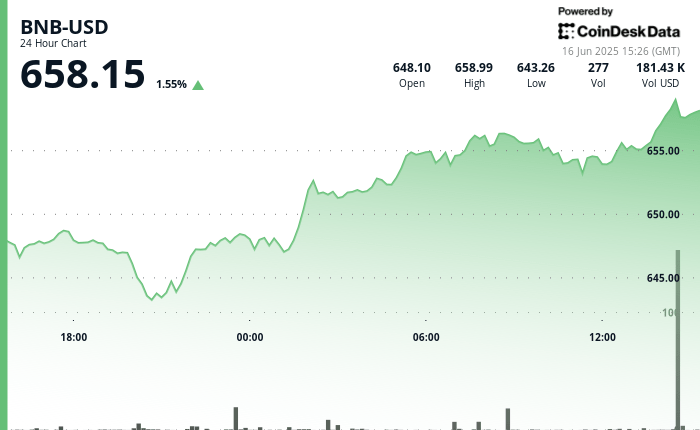

BNB saw strong purchase interests throughout the day, remaining firm at the level of $ 646 and surpassing $ 658. That force was backed by an unusually high volume and what seemed to be an institutional interest.

Technically, BNB is benefiting from a higher minimum chain, a sign of a higher tendency of the building, according to the technical analysis data model of Coindesk Research. Analysts also indicated consistent volumes above average, suggesting more than just retail enthusiasm.

The open interest in BNB derivatives has fallen 6.9% week after week to $ 750 million, indicating caution among merchants. However, the broader fear and greed index is found in a 51 neutral, which suggests that the feeling has not inclined bassist despite the geopolitical nerves.

Discharge of responsibility: parts of this article were generated with the assistance of the AI tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy.