The price of BNB saw acute intimate changes in the last 24 -hour period, since it continued to fall from a historical maximum of $ 900 seen at the end of last month.

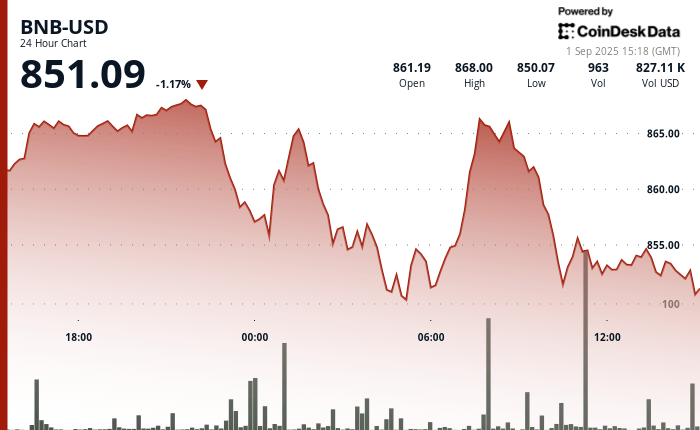

During a 24 -hour window, the asset quoted between $ 849.88 and $ 868.76, a 2% movement that began with a bullish impulse but ended with signs of fatigue near resistance.

Volatility follows the presentations before the US stock and securities commission. UU. For REX actions at the end of last month, together with the increase in BNB -centered treasure companies. The last B strategy aims to have up to $ 1 billion in BNB with the support of the investment firm led by the co -founders of Binance Changpeng Zhao and Yi He.

While BNB failed to hold on to his earnings from the activity of the previous underlying network. Daily active wallet addresses in the BNB chain doubled, rising to almost 2.5 million according to defriting data.

However, transaction volumes have constantly decreased since the end of June, as shown in the same source data. The BNB price drop is also ahead of the key economic data of the US. This week, including manufacturing and services and payroll figures in August.

Job data could influence the probabilities that the Federal Reserve reduces interest rates this month. As it is, the CME Fedwatch tool weighs a probability of almost 90% of a 25 BPS cut, while Polymeket merchants put the probabilities at 82%.

General description of the technical analysis

BNB entered the session with an increase of $ 860.30 to $ 868.08, but the rally quickly lost steam. The heavy sales pressure emerged around the level of $ 867– $ 868, an area that has now been established as a key resistance roof, according to the technical analysis model of Cindensk Research.

The volume increased during this attempt, reaching its maximum point by 72,000 tokens, well above the average of 54,000, indicating a high level of participation during the failed break.

After rejection, BNB became related to the range of $ 850- $ 855, where purchase interests arose. This was more visible as the Token fell to $ 851.40, which caused a volume peak. This answer pointed to a solid demand at these lower levels.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.