The native token of Bump.fun, Pump, has stolen the recession of the entire market this week, increasing by 17% as the protocol takes advantage of the platform rates to repurchase tokens.

The repurchases are designed to support the holders by reducing the circulating supply and the absorbent sales pressure, an increasingly common model in cryptographic projects.

At the time of the publication, Pump is quoted at $ 0.0035, approximately 40% more than a month ago, but still decreased 50% of its debut in July, when it quickly fell from $ 0.007 to $ 0.0024 in just 10 days.

The strong decline after launch reflected the fading of the initial exaggeration, but the recent impulse suggests that the repurchases are helping to stabilize the Token market.

The controller is the FUN income engine. The platform gains rates in each token created through its service, a model that has generated $ 734 million during the past year, with volumes reached in January during the boom in meme coins promoted by celebrities such as Trump and Melania, along with thousands of imitation tokens that followed.

Since the beginning, more than 12.5 million tokens and 23 million wallets have interacted with the site, establishing a solid user base.

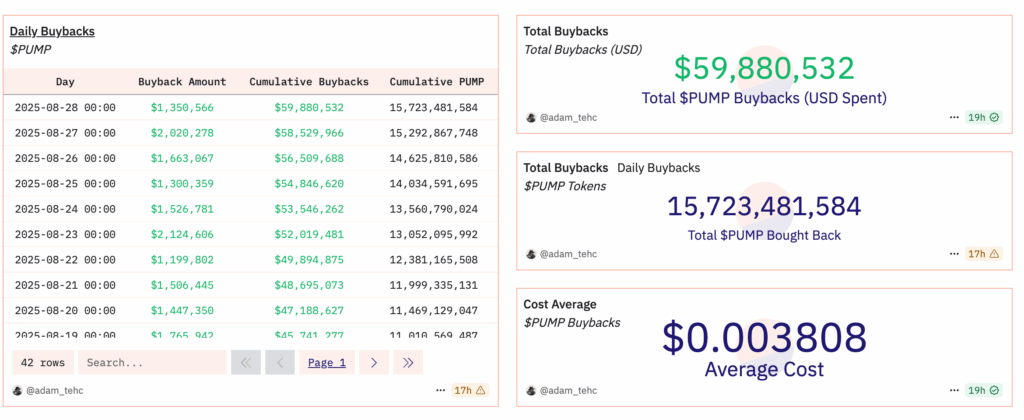

These flows have resulted in a significant token support: the pump. He has directed $ 59 million to the repurchases, according to Dune Dashboards, which helps to prop up the bomb bomb.

The moment could be fortuitous. Autumn has historically been a stronger season for digital assets after summer pause, suggesting that conditions could be aligned for more rise.

Even so, the pump remains far from its launch maximums, and its trajectory will depend on whether tariff income can remain consistent in a deceleration market.

Meanwhile, the largest remain under pressure: Bitcoin is quoted at $ 108,500 and ether at $ 4,337, both low between 6% and 7% this week.