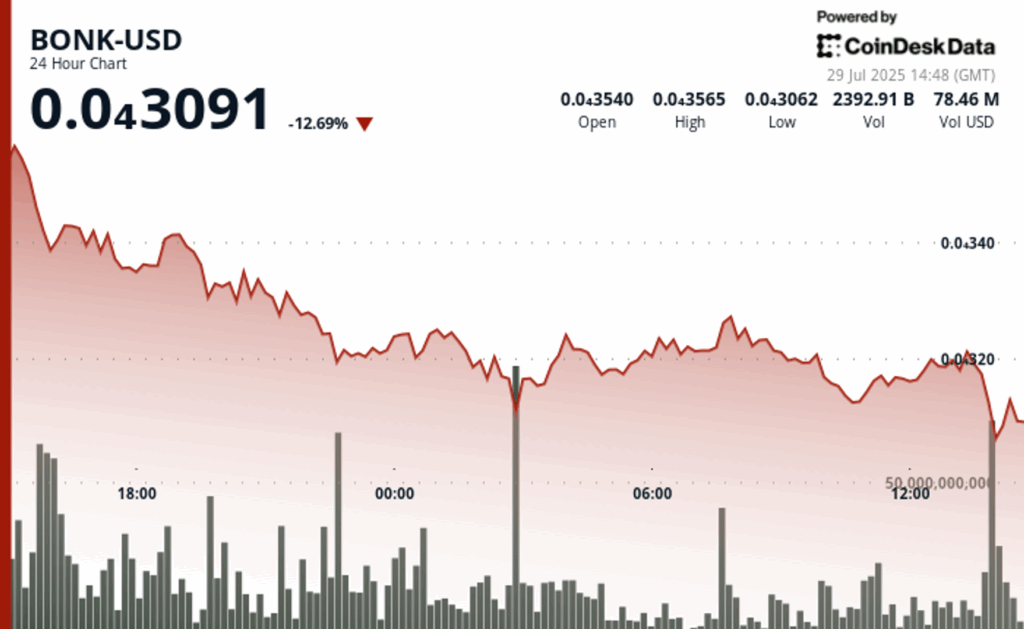

Bonk, a Meme token with headquarters in Solana, slid 14% in the last 24 hours, falling from $ 0.000035 to $ 0.00003096.

The Token experienced high volatility, with a commercial volume greater than 2.39 billion Bonk, which suggests an aggressive reposition among institutional participants.

The market resistance was established early around the level of $ 0.000036, where the pressure side pressure increased, coinciding with the data books that show institutional liquidations by a total of more than 2.6 billion tokens, according to the technical analysis data model of Coindesk Research.

Temporary stabilization occurred during the night, with support that was formed about $ 0.000031 as a volume of the sales side cooled to 1.48 billion tokens, but the ascending impulse remained limited.

The most pronounced losses arrived between 13:06 and 14:05 UTC on July 29 when Bonk fell 3%.

The quantitative models of high frequency commercial companies suggest that it could be a greater inconvenience, with an impulse that indicates a rupture below the key support threshold of $ 0.000031. Unless institutional demand arises, Bonk can be derived towards the psychologically significant level of $ 0.000030 in the short term.

TECHNICAL ANALYSIS

- The price fell 13.6% in 24 hours.

- The trade varied from $ 0.00003565 (high) to $ 0.00003062 (bass), a swing of 14.1%.

- Institutional sale with an increase of more than 2.6 billion tokens near resistance at $ 0.000036.

- The temporal support was formed around $ 0.000031 with 1.48 billion absorbed tokens.

- The decline of the final hour saw Bonk fall from $ 0.000032 to $ 0.000031, with 60b+ tokens negotiated.

- Algorithmic trade volumes increased between 13: 53–14: 03, a potential sign of detention triggers.

- The Quant models project is possible to decrease even more around $ 0.000030 if the resistance is maintained.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.