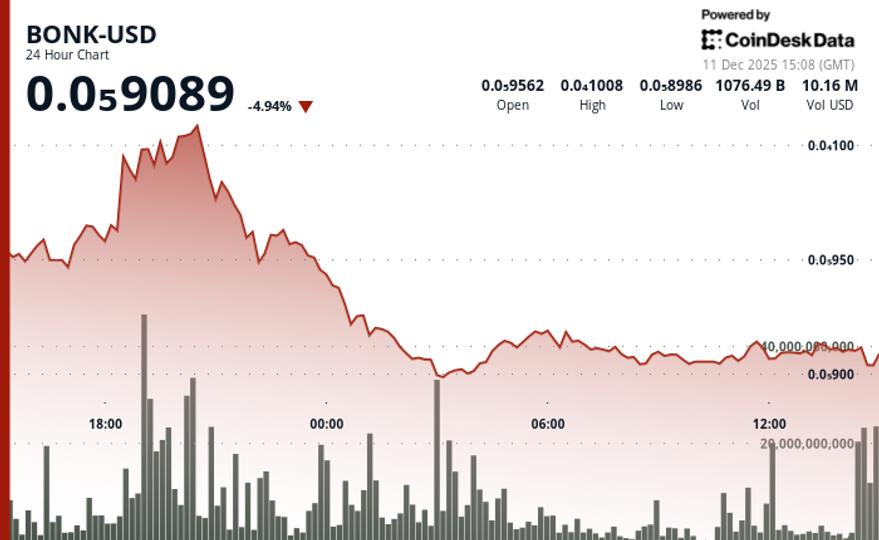

BONK fell 4.5% in the last 24 hours, falling from $0.000009524 to $0.000009097 after previous strength sharply reversed into a key resistance zone.

The token’s intraday range reached 11.8%, with the price action reaching a high of $0.000010183 before turning lower and settling into a tight consolidation band, according to CoinDesk Research’s technical analysis data model.

A substantial increase in trading activity marked the reversal point, with volume increasing to 2.03 trillion tokens during the move towards the $0.00001010 area. The scale of activity at that level reinforced its importance as a ceiling that limited bullish attempts. Once the rejection consolidated, BONK trended steadily lower before stabilizing above $0.00000910, where volatility contracted during the latter part of the session.

BONK attempts to stabilize near support, with hourly data capturing several brief upside tests towards $0.000009147, accompanied by intermittent volume spikes of approximately 27.6 billion tokens. These movements indicate that market participants were active around the lower limit of the range, and the price action forms the initial structure of a possible consolidation base heading into the next session.

Short-term positioning now depends on whether BONK can maintain stability above the $0.00000910 zone. A move through nearby resistance between $0.00000915 and $0.00000920 would indicate significant progress in undoing Tuesday’s decline, while failure to hold the support increases the risk of a retest towards the $0.00000890 region.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk’s full AI policy.