Like Bitcoin

Near a new historical maximum, the Memecoin based in Solana, Bonk, leads the largest Altcoin rally.

The increase coincides with renewed optimism in risk assets after Bitcoin recovery above $ 110,000, which has caused generalized profits in established cryptocurrencies.

Bonk’s impulse seems sustainable since numerous cryptographic analysts express a bullish feeling, citing a remaining significant ascending potential.

In addition to Bonk’s upward case, the Token LaunchPad of the Bonk Foundation, Letsbonk.Fun, recently exceeded the competition bomb. FUN in daily volume with an increase of 126%. This development benefits BONK holders as 50% of the platform’s income are assigned to buy and burn Bonk tokens, creating additional positive price pressure in a market that already anticipates the next burn of 1 billion tokens when the project reaches the 1 million holders.

Meanwhile, Tuttle Capital Management confirmed on July 16 as the earliest possible release date for its aired cryptographic ETF set, including a 2 × Bonk ETF, feeding the upward feeling.

TECHNICAL ANALYSIS

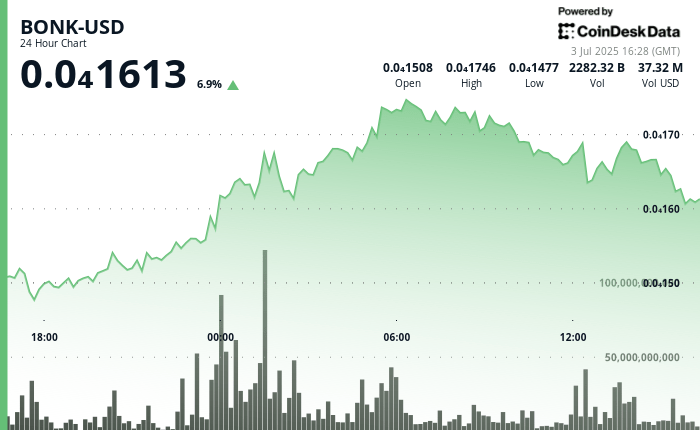

- The Bonk-UD pair experienced a greater purchase pressure during the last 24 hours, from July 2, 4:00 p.m. UTC, until July 3, 15:00 UTC. It rose from $ 0.0000147 at a peak of $ 0.0000175, which represents a range of 10.4%, according to the technical analysis model of Coindesk Research.

- A significant volume increase to 2.9 billion at midnight on July 3 established strong support at the level of $ 0.0000157, while the high volume purchase at the level of $ 0.0000168 during the bossed prices of 05:00 Higher UTC hours despite the earnings of the late session, the model showed.

- However, during the last 60 minutes of July 3 at 14:50 at 15:49 UTC, Bonk-USD experienced significant volatility, falling from $ 0.0000166 to a minimum of $ 0.00001619 before recovering at $ 0.00001624.

- An increase in remarkable volume of 86.9 billion at 15:35 coincided with the price that gave a fund to $ 0.00001619, establishing a key support level. The posterior recovery formed an ascending line of trend with increasing volumes, particularly at 15:49, where 22.5 billion volume raised prices by 2.7% from the low session, according to the model.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.