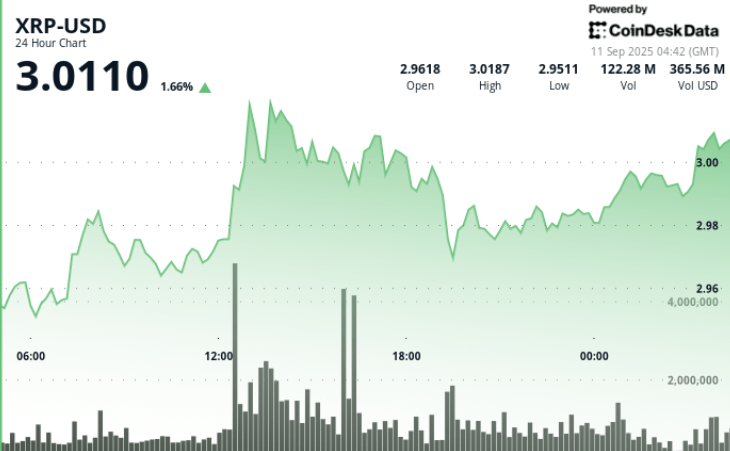

XRP pierced the psychological threshold of $ 3.00 in a heavy volume session that indicated strong institutional flows.

The rally took the token from $ 2.96 to $ 2.99 in 24 hours, with noon outbreaks in volumes six times the daily average.

Despite facing the resistance about $ 3.02, the market structure suggests accumulation, with bulls that defend the support of around $ 2.98 as merchants evaluate the impulse for an impulse towards higher extension levels.

News history

• The September 10 Rally was fed by an explosion of volume of 116.7my 119.0m units within 12: 00–13: 00 hours, far exceeding the average of 24 hours of 48.3m.

• The open interest of the futures rose to $ 7.94b, showing a placement of high derivatives together with the punctual activity.

• Analysts mark a scenario of rupture of the descending triangle with objectives measured in the $ 3.60 area if the impulse persists.

• The broader risk assets continue to track the expectations of the Federal Reserve, with fees of fees that support the flows in cryptographic assets of great capitalization.

Summary of the price action

• XRP advanced from $ 2.96 to $ 2.99 on September 9 from 9:00 p.m. September 10, 20:00 Negotiation window, a 1% gain within a $ 0.09 band.

• The rupture occurred during the 12: 00–13: 00 window, when XRP increased from $ 2.98 to $ 3.02 in volume of 119m, establishing a short -term resistance zone.

• The final time of the sale pressure pushed the token at $ 2.98, before the buyers restored the support and closed about $ 2.99.

• The volume peaks of more than 1.6 million per minute during the late session confirmed the institutional offers intervening at discount levels.

Technical analysis

• Resistance: $ 3.02 is still the immediate roof after multiple rejections during maximum trade.

• Support: Buyers repeatedly defended $ 2.98– $ 2.99 in multiple reestimations.

• Volume: The rupture volumes at noon were six times the daily average, validating the movement.

• Structure: The formation of higher minimums suggests a sustained accumulation despite the resistance limits.

• Indicators: Technicians point to a rupture scenario, with Fibonacci extensions that project up to $ 3.60.

What merchants are seeing

• If XRP can keep the closures above the $ 3.00 brand to turn the support to support.

• Reaction to the resistance of $ 3.0: A break could extend the objectives at $ 3.20 – $ 3.60 in the next sessions.

• Future positioning and open interest to $ 7.9b, which could amplify volatility around key levels.

• Macro drivers of the Federal Reserve policy meeting and the dollar liquidity perspective.