Bitcoin (BTC) Price Recovery has gathered the traction before the job report in the United States on Friday.

The leading market for market value increased to $ 113,000, its highest level since August 28, and registered its first highest maximum since mid -August of all time of $ 124,000, according to Coendesk data.

In technical terms, a high high indicates a potential bullish reversal in the trend, since the price exceeds its previous short -term peak.

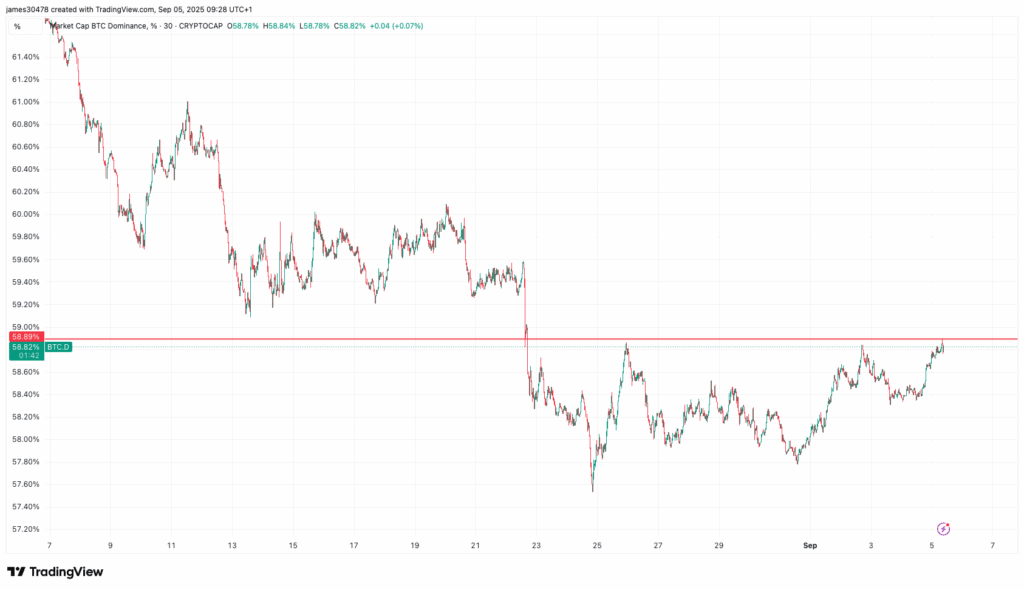

Bitcoin market domain, which represents its participation in the total cryptography market, also rose to a maximum of two weeks of almost 59%, above a minimum of 57.5%. It indicates renewed capital entries in Bitcoin, a change in recent market dynamics characterized by whales that turn outside BTC and ether.

Bunce led by Max Dust?

The BTC price bounce of the minimums of the Asian session may have been catalyzed by the maximum pain theory, which suggests that prices gravitate towards the maximum pain level as the options approach.

Bitcoin Options worth $ 3.28 billion expired at 8:00 UTC in Deribit, with a maximum pain at $ 112,000. It is the price level where options for options suffer the greatest loss.

According to the theory, as the expiration approaches, the options of options, typically institutions with a wide offer of capital, seek to boost the specific price towards the maximum pain point in an attempt to inflict the maximum pain to the buyers of options. They do it negotiating the underlying asset in the spot/futures market.

The BTC price increased above $ 112,000 on early Friday in the period prior to expiration, aligning with the maximum pain theory almost perfectly for the first time. The maximum pain theory is widely discussed and is considered valid in traditional markets, where it is used to anticipate price movements near the options. However, some cryptographic experts remain uncertain about whether the theory operates effectively in the Bitcoin market.

Merchants are now waiting for the US jobs report at 8:30 ET for the next potential driver.