Mining difficulty in Bitcoin

Blockchain is ongoing to fall more since July 2021 after the amount of mining energy that ensures the network slid about 30% in two weeks.

According to Mempool.Space data, a difficulty adjustment is projected down around 9% in the next five days. That would be the greatest amount from the Chinese mining prohibition four years ago, when the hashrate, the total computational power used to extract the blocks, fell 50% to 58 exahashes per second (EH/s) and Bitcoin quoted about $ 30,000.

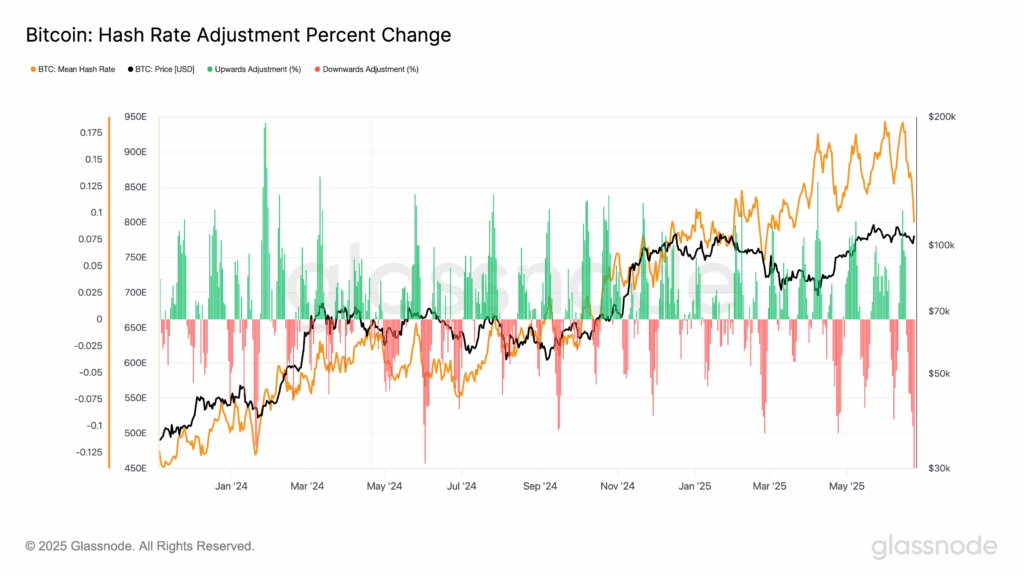

The difficulty adjusts every 2,016 blocks to ensure that the blocks continue minted at intervals of approximately 10 minutes. After the recent decrease, the hashrate now has just under 700 EH/s, according to Glassnode data. The largest cryptocurrency for market capitalization recently traded around $ 105,300.

The significant hashrate and difficulty corrections are not unusual during the summer of the northern hemisphere. High prices of electricity, driven by a greater demand for air conditioning and tense energy networks, often lead the miners to temporarily close the machines, especially the largest or less efficient. This seasonal pattern has been observed in several previous years.

The anticipated fall in mining difficulty will provide significant relief for miners. The hashprice, or the income of miners by Exahash, is currently at $ 51.9. This metric reflects the daily income estimated in dollars that a miner wins for eh/s contributed to the network, depending on block rewards and transaction rates.

As difficulty decreases, mining becomes easier, which means that miners can obtain more income from the same amount of computational effort. Assuming that the price and transaction rates of Bitcoin remain stable or increase, hashprice should increase significantly in the next few days, which helps compensate for the recent profitability pressure.