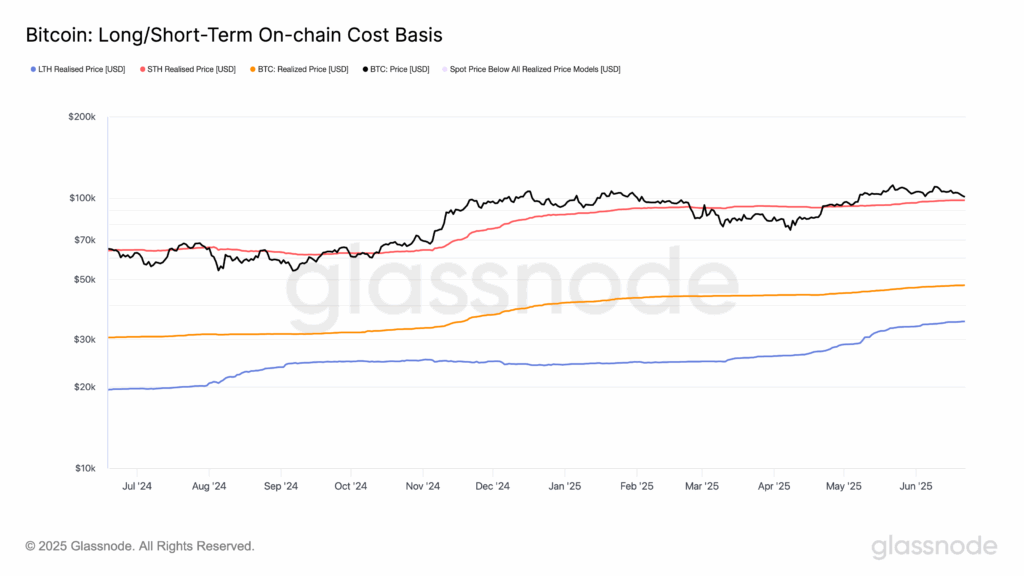

The short -term holder price made (STH RP) for Bitcoin

It is currently at $ 98,200, which represents the average chain acquisition price for Bitcoin BTC held out of exchange reserves and moved in the last 155 days.

This metric, derived from heuristics in the chain, helps distinguish between short and long term holders and provides information about the market feeling, according to Glassnode data.

The price made refers to the average acquisition price of the entire circulating bitcoin supply, according to the last time each currency moved in the chain. STH RP reduces this to more recently active coins, which are statistically more prone to spend. These are often the most sensitive to market volatility.

During the weekend, Bitcoin immersed himself in the midst of geopolitical tensions, driven by the growing conflict between Israel and Iran, and the growing fears of climbing between us and Iran. With the traditional markets closed, investors responded by selling liquid assets such as Bitcoin not necessarily by desire, but necessity.

Historically, when Bitcoin quotes above the STH RP, he usually points out an upward trend. On the contrary, trade below the STH RP is often associated with bearish or consolidation phases.

For example, from June to October 2024, before the presidential elections of the United States, Bitcoin remained below the STH RP, which was around $ 62,000 at that time. Similarly, in February to April 2025, prices again fell under this threshold that was around $ 92,000.

Bitcoin has recovered strongly, rising above $ 100,000 and now quoting around $ 101,000. To continue the bullish impulse, it will be crucial for BTC to remain above the RP STH level of $ 98,200.