It is likely that the business war of the current-China in progress reduces inflation in the economy of the United States, indicate key sections of the financial market, which offer bullish signals to risk assets, including Bitcoin (BTC).

In his inaugural speech on January 20, President Donald Trump promised “tariffs and taxing foreign countries to enrich our citizens”, and then fired the first shot against China, Canada and Mexico on February 1. Since then, commercial tensions have intensified to such an extent that from the writings, the United States and China have imposed on imposing rates with each other in the 100%exsium.

Tariffs increase the cost of imported goods, which are then transmitted to the consumer and could lead to a higher general price level in an economy driven by consumption such as the United States.

Consequently, since the commercial war broke out, the markets have been concerned with a resurgence led by rates in the United States inflation, and the Fed adds to those concerns through their economic projections of stagning last month. Stanflation, which represents a combination of low growth, high inflation and unemployment, is considered the worst result for the most risky assets.

Bitcoin, therefore, has fallen almost 20% since the beginning of February, along with the aversion to wide -based risks in Wall Street that has seen investors to pour shares, bonds and US dollar.

Breakevens suggests disinflar

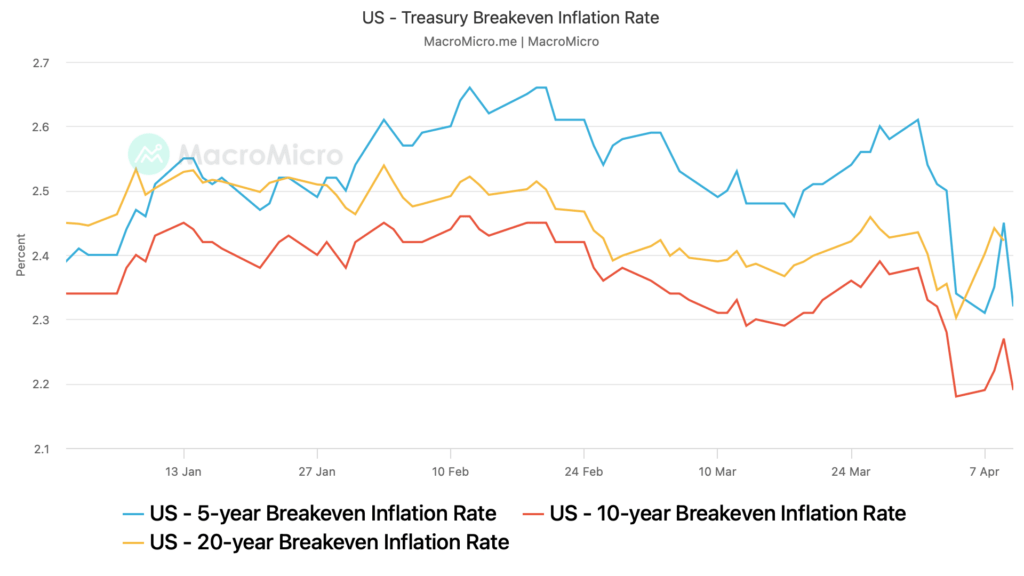

However, market -based inflation measures, such as Breakevens, suggest that tariffs could be long -term defaults. In other words, the Fed could be wrong to fear the stagflation and will soon have a margin of maneuver to reduce rates.

Urine inflation yields of traditional treasure bonds with yields of values (advice) protected by treasure inflation. The inflation rate of five years of equilibrium reached a maximum of 2.6% in early February and since then has fallen to 2.32%, according to data tracked by the Federal Reserve Bank of St. Louis.

The 10 -year equilibrium rate has decreased from 2.5% to 2.19%. Meanwhile, the expected two -year inflation of the Bank of the Cleveland Federal Reserve has remained in around 2.6%.

Unique cost

According to observers, the impact of tariffs, seen as a unique cost adjustment, is based on the reactions of other macroeconomic variables and tends to be a long -term defilizer.

When producers pass the increase in the rate to consumers, inflation levels increase. However, if there is no corresponding increase in income, consumers are forced to reduce their consumption. This reduction can lead to the accumulation of inventory and, ultimately, contribute to a decrease in the prices of goods and services.

“Since the days of Smoot-Hawley, tariffs have never been inflationary. Rather they are deflationary and” stimulants in themselves. “In addition, the deflation shown in these graphics will help encourage Fed to facilitate soon.

An article published by the American economist Ravi Batra in 2001 made a similar observation, saying: “Tariffs in the US.

After all, the recent turbulence of the financial market probably resulted from growth fears instead of inflation. The bull could soon resurface in anticipation of a deceptive position of the Federal Reserve.