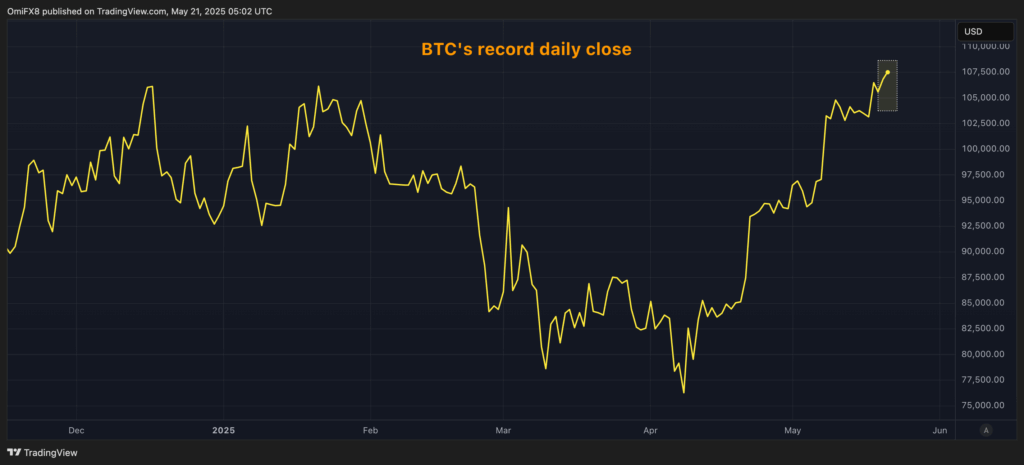

Although Bitcoin (BTC) can be negotiated 24 hours a day, 7 days a week, their sails open and close daily in a similar way to currency markets. The latest TrainingView data shows that Tuesday’s candle ended (UTC) to $ 106,830, the highest daily closing price.

The upward movement occurred when investors invested money in the funds quoted in exchange (ETF) in the middle of a chaotic price action in the bond markets that suggested high concerns about the fiscal health of the main economies, including the US.

The analysts told Coindesk last week that the worsening of the situation of the fiscal debt could be a good omen for BTC and other assets such as gold.

The Coinbase Bitcoin Prima Index, which measures the percentage difference between the price of Bitcoin in Coinbase Pro (PAR) and the price in Binance (USDT trade pair), remained positive, indicating a persistent purchasing pressure of investors based in the United States.

With the upward trend in Progreso, the next key level to see is $ 110,000. Delibit BTC options data, tracked by Amberdata, show that market concessionaires or manufacturers have a large net exposure of “negative gamma” at the level of $ 110,000.

The dealers who have negative gamma generally trade/coverage in the market management to maintain its general exposure delta to the neutral market. That, in turn, amplifies the bearish and bullish movements.

In other words, the rally can accelerate in a possible rupture above the $ 110,000 mark. The options market has grown significantly in the last five years, with the coverage of the dealership increasing volatility on several occasions.