Bitcoin investors (BTC) seek to spend more than four consecutive losses on Monday.

In recent weekends, the largest cryptocurrency has experienced significant price volatility, driven by macroeconomic uncertainty that includes geopolitical tensions, rates and increased yields of global bonds. The nervousness of the weekend seems to have moved to Monday.

Velo data show that the last three months on Mondays and Thursdays have been the most negative days of regular work week. On Sunday, however, it stands out as the worst day of the week in general, with an average price decrease of 1%. In general, weekends work a little worse than week days in terms of performance.

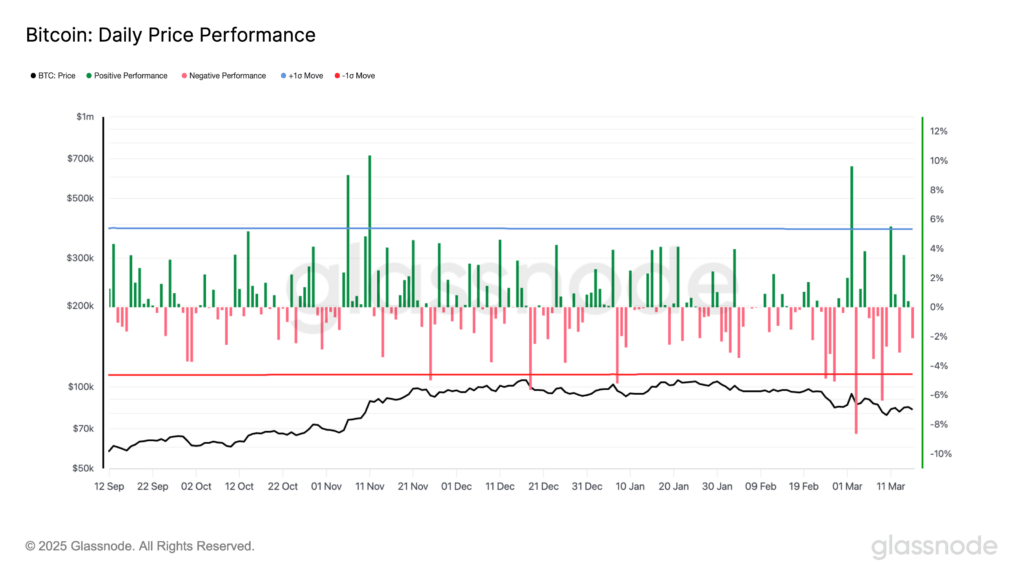

Bitcoin has fallen the last four Monday, as shown in the coinglase data. Lost 0.31% on February 17, 4.6% on February 24, 8.5% on March 3 and 2.6% on March 10. It has decreased 30% of its historical maximum at the end of January, coinciding with a 10% slide in S&P 500.

The S&P 500 has also experienced three consecutive loss Monday. It was not negotiated on February 17 due to an American vacation.

Bitcoin is quoted only 1.4% more in 24 hours, while future S&P 500 have become slightly negative. What happens next is an assumption of anyone.