By Omkar Godbolole (all time and unless otherwise indicated)

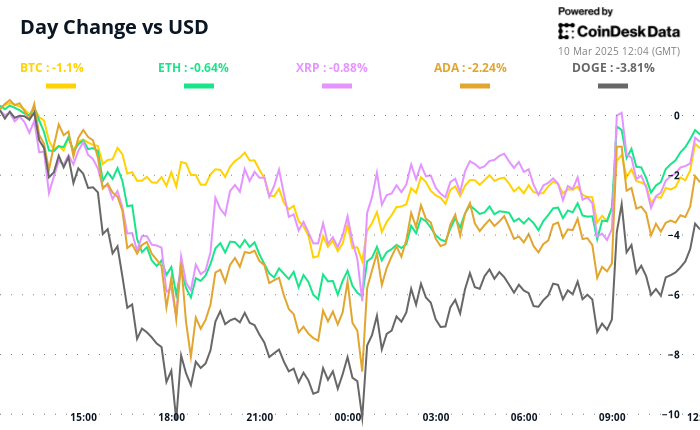

The cryptography market continues to lose ground, driven by disappointment due to the absence of a plan for the United States government to buy Bitcoin under the newly announced strategic reserve plan and amid persistent macroeconomic concerns.

BTC fell to $ 80,000 on Sunday night, quoting below the simple 200 -day mobile average, and Ether took a line of macro bullish trend with a dip below the long support of $ 2,100. Other currencies followed the two specialties, publishing greater losses.

“Many investors withdraw from Bitcoin, seeing it as a class of risky assets for the first time since Trump took the White House,” said Zach Burks, CEO and founder of NFT-Service Mintology. “It is no longer playing its role as a value reserve. Gold prices have become, since many date back to the” doomsday asset “”, which is not a surprise since rates and grenades continue to be thrown by the free world. ”

Tariffs are making Fed progress with tariff cuts despite the continuous tendency of decrease in real -time inflation indicators. On Friday, the president of the Fed, Jerome Powell, said that the Central Bank is waiting for greater clarity about Trump’s policies before making the next movement.

Meanwhile, the fastest base salary increase in Japan in 32 years strengthened the case of an increase in boxwood rates, which drives the yields of the nation’s bonds and the highest yen. The episodes of force in the shelter currency usually reproduce volatility down in risk assets.

Even so, some observers are not sure if the weakness of the market, particularly seen during the weekend, could be lasting. “Commercial volumes during the weekend were extremely low, reducing the value of the bearish signal,” Alex Kuptsikevich, FXPro’s chief market analyst, told Coindesk.

“We observe that sellers drive the price in periods of low liquidity, but the price bounces in the arrival of institutional buyers. It seems that large buyers have enough liquidity to buy the reduction,” Kuptsikevich said. Stay alert!

What to see

- Crypto:

- Macro

- March 10, 7:50 PM: GDP data from the Japan Cabinet Cabinet Office (Final).

- Annualized GDP growth Prev. 1.2%

- GDP growth rate QOQ Est. 0.7% vs. Prev. 0.3%

- March 11, 8:00 am: The Brazilian Institute of Geography and Statistics (IBGE) releases industrial production data in January.

- INDUSTRIAL PRODUCTION MOM Prev. -0.3%

- Industrial production Yoy Prev. 1.6%

- March 11, 10:00 am: The Jolts report of the US Department of Labor. January (work openings, hiring and separations).

- Work openings Est. 7.71m vs. Prev. 7.6m

- Job Abandon Prev. 3,197m

- March 10, 7:50 PM: GDP data from the Japan Cabinet Cabinet Office (Final).

- Earnings (Estimates based on data data)

- March 17 (TB): Bit Digital (BTBT), $ -0.05

- March 18 (TB): Terawulf (Wulf), $ -0.04

- March 24 (TB): Galaxy Digital Holdings (TSE: GLXY), C $ 0.39

Token events

- Government votes and calls

- You unlock

- March 12: Aptos (APT) Unlock 1.93% of the circulating offer for a value of $ 62.09 million.

- March 15: Starknet (STRK) will unlock 2.33% of its circulating supply for a value of $ 10.25 million.

- March 15: SEI (SEI) will unlock 1.19% of its circulating supply for a value of $ 10.99 million.

- March 16: Arbitrum (ARB) Unlock 2.1% of its circulating supply for a value of $ 33.46 million.

- March 18: Fasttoken (FTN) Unlock 4.66% of its circulating supply for a value of $ 80 million.

- March 21: Immutable (IMX) to unlock 1.39% of the circulating offer worth $ 13.13 million.

- Tokens listings

- March 11: Bybit to Delist Bancor (BNT), Gold Paxos (Paxg) and threshold.

- March 31: Binance to Delist USDT, FDUSD, Tusd, USDP, DAI, AEUR, UST, USTC and PAXG.

Conferences

Token talk

By Shaurya Malwa

- Zerebro (Zerebro), once a famous AI agent token, 96% of its January market capitalization has crashed from more than $ 800 million to only $ 33.5 million.

- The tokens of AI agents were among the most popular sectors in October and November, seeing rapid lists of exchanges and promotion of influential people in the narration of a confluence between crypto and artificial intelligence.

- Zerebro created his own music album and offered NFT to fans, with plans to introduce a platform that allows tokens headlines to launch their own AI agents. He reached more than 120,000 followers in X in a short period.

- However, the foundations remain solid, offering hope for those who seek to invest in tokens of AI agents. The project was selected as one of the validadores of Blockchain Story focused on IP last week, playing a role in a future economy that is fully directed by agents and AI machines.

- A validator is a critical participant in a blockchain network, responsible for verifying and validating transactions and blocks to guarantee the safety and consensus of any network.

- The validators of the history protocol have specific responsibilities adapted to the mission of the protocol to manage and monet intellectual property in a block chain, and the validators are paid in exchange for ensuring that the network continues to function.

Derivative positioning

- Perpetual financing rates in BTC, Sol, Ada, XRP and TRX have turned negative, pointing out a bias for shorts as the market withers.

- The open interest in futures linked to BNB, Hype, OM and DOT has increased in the last 24 hours, a sign of merchants that shorten in a market that falls.

- In Delibit, merchants have broken to $ 85K and $ 80K strikes, while long positions in the $ 75K placed are implemented or moved to the June expiration.

- Eth Puts has also been in demand, quoting with a premium to call the expiration of June.

Market movements:

- BTC has dropped 4.61% from 4 pm et on Friday at $ 82,373.88 (24 hours: -3.21%)

- ETH has dropped 1.6% to $ 2.101.66 (24 hours: -2.04%)

- COINDESK 20 has dropped 6.4% to 2,632.12 (24 hours: -3.26%)

- The commitment rate composed of CESR Ether Cesr has dropped 8 PB at 3%

- The BTC financing rate is at 0.0015% (1.67 annualized) in Binance

- DXY has dropped 0.14% to 103.76

- Gold has increased 0.15% to $ 2,909.10/Oz

- La Plata rises 1.14% to $ 32.92/oz

- Nikkei 225 closed +0.38% at 37,028.27

- Hang Seng closed -1.85% to 23,783.49

- Ftse fell 0.59% to 8,629.02

- Euro Stoxx 50 has dropped 0.96% to 5,415.85

- Djia closed Friday +0.52% to 42,801.72

- S&P 500 closed +0.55% to 5,770.20

- Nasdaq closed +0.7% to 18,196.22

- The closed S&P/TSX compound index +0.71% to 24,758.80

- S&P 40 Latina America closed +0.73% to 2.361.82

- The 10 -year Treasury rate has dropped 5 bp with 4.25%

- E-mini s & p 500 futures have dropped 1.16% to 5,709.25

- E-mini nasdaq-100 futures have dropped 1.34% to 19,958.25

- E-mini dow Jones The industrial average index has dropped 0.96% to 42,428.00

Bitcoin statistics:

- BTC domain: 61.19 (-0.14%)

- Bitcoin Ethereum ratio: 0.02562 (2.40%)

- Hashrat (seven -day mobile): 813 eh/s

- HASHPRICE (SPOT): $ 48.2

- Total rates: 4.4 BTC / $ 371,994

- Cme future open interest: 142,260 BTC

- BTC with a gold price: 28.2 oz

- BTC vs Gold Market Cap: 8.01%

Technical analysis

- BTC has divered below a flag pattern, hinting at the continuation of the broader decrease in December maximums.

- The breakdown has strengthened the case of a new test of the previous resistance turned into support to around $ 73,800, the maximum of March 2024.

- A flag is a continuation pattern, which represents a triangular consolidation of middle trend.

Cryptographic equities

- Strategy (MSTR): closed on Friday at $ 287.18 (-5.57%), 5.33% to $ 271.87 in the previous market

- Global Coinbase (Coin): Closed at $ 217.45 (+1.53%), 5.36% at $ 205.79

- Galaxy Digital Holdings (GLXY): Closed at C $ 18.84 (+0.11%)

- Mara Holdings (Mara): closed at $ 16.02 (+6.16%), less 4.24% at $ 15.34

- Riot Platforms (Riot): closed to $ 8.37 (+3.21%), 4.42% at $ 8

- Core Scientific (Corz): closed at $ 7.78 (-0.89%), less than 2.7% at $ 7.57

- CleanSTark (CLSK): closed at $ 8.83 (+8.34%), less than 3.85% at $ 8.49

- COINSHARES VALKYRIE BITCOIN MINERS ETF (WGMI): Closed at $ 16.32 (+3.29%), 6.25% at $ 15.30

- Semler Scientific (SMLR): closed at $ 37.19 (+3.02%), 3.47% at $ 35.90

- Exodus movement (exod): closed at $ 29.40 (+0.34%), 6.22% more in the previous market

ETF flows

Spot BTC ETF:

- Daily net flow: -$ 409.3 million

- Cumulative net flows: $ 36.21 billion

- Total BTC holdings ~ 1,137 million.

Spot Eth Ethfs

- Daily net flow: -$ 23.1 million

- Cumulative net flows: $ 2.72 billion

- Total eth holdings ~ 3,635 million.

Source: Farside Investors

Flows during the night

Figure of the day

- The painting shows the daily volume in the decentralized exchange of Solana, Raydium has fallen to $ 1 billion, the lowest since November 29 and significantly below the January 19 peak, $ 16.4 billion.

- The strong decrease in activity helps explain fainting in the Token Sol de Solana.

While you sleep

In the ether