Much to the dismay of the bulls, crypto markets continued their swinging action again on Thursday, with the initial large gains being more than reversed in a very short period of time.

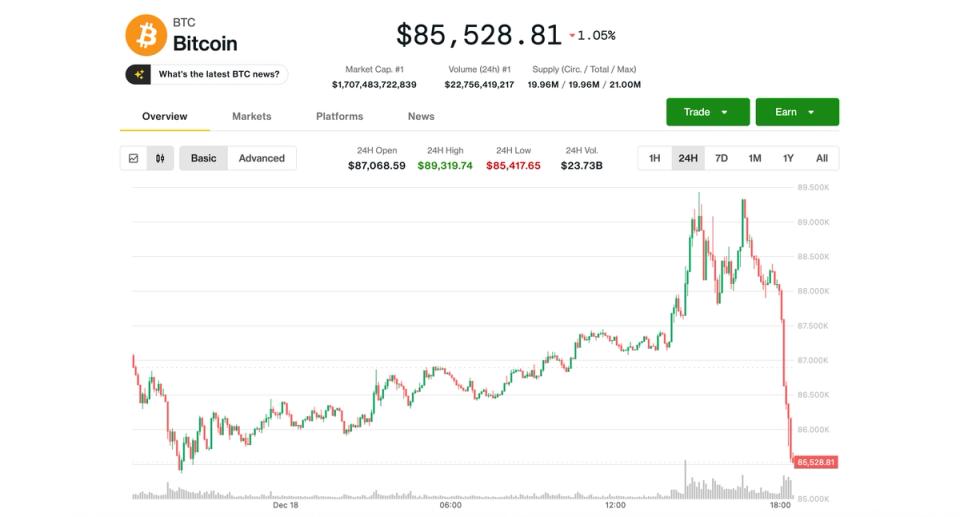

Happening over a period of a couple of hours instead of just a few minutes yesterday, the size of today’s reversal was almost as large, with the leading cryptocurrency bitcoin. falling from a session high of $89,300 to a low of $85,500. At press time, BTC was changing hands at $86,000, down 0.8% in the last 24 hours. The Nasdaq was off session highs of around 2%, but was still well ahead with a 1.7% advance.

The early gains came alongside a much colder-than-expected November US consumer price index report, with headline inflation falling to 2.7% from 3% previously. That data led some to quickly point to another Federal Reserve rate cut in January, which, all things being equal, would tend to be good for risk assets, including cryptocurrencies.

Skeptics, however, quickly jumped on the outlier inflation figures. “The main problem was reducing the owner’s rent/equivalent rent (REA) to zero in October,” wrote well-known economist Omair Sharif. Unless the BLS adjusts, he continued, it will artificially lower CPI numbers year after year through April.

“This is totally inexcusable,” wrote the WSJ’s Nick Timiraos. “The BLS simply assumed the rent/OER was zero for October… There is simply no world in which this would be a good idea.”

For now, markets seem to agree with the skeptics, as the odds of a rate cut in January have not moved from their previous slim probability of 24%.

BTC range, ETH coverage

Traders in the crypto options market appear to be adjusting their expectations, with bitcoin and ether showing divergent feelings, according to Wintermute data. Bitcoin options activity points to a rangebound outlook as traders continue to sell downside protection below $85,000 and limit upside exposure above $100,000.

This “points to confidence in the maintenance of support and limited expectations of a sustained breakout in the near term,” the market maker’s OTC trading desk wrote in a note.

Ether options, on the other hand, show less conviction and more hedging behavior. Support appears to be forming around the $2,700 to $2,800 range, but bullish calls above $3,100 are selling aggressively, suggesting traders are looking for upside protection.