Cryptographic markets experienced a relatively quiet day on Friday despite a renewal of tariff threat.

Bitcoin

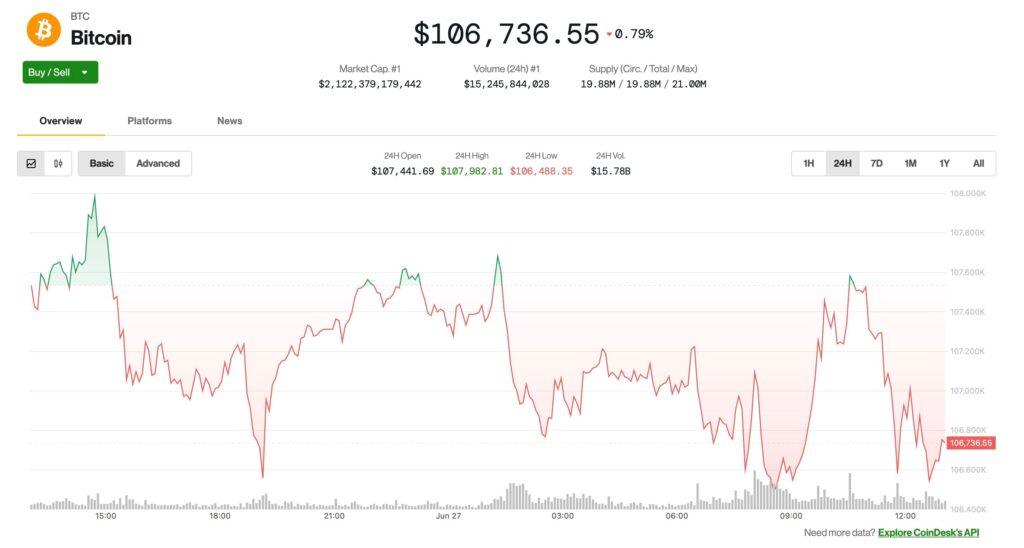

It has dropped 0.7% in the last 24 hours, now contributing for $ 106,700, according to Coindesk market data.

Orange’s currency performance was widely in line with the Coendesk 20, an index of the 20 main cryptocurrencies for market capitalization, with the exception of stablocoins, memecoins and currency exchange, which fell 0.7% in the same period of time. Sui

It was the index tab that experienced the greatest price change in any way, and only increased 3.3%.

Crypto’s actions saw more significant movements, with coinbase (COIN) and circle (CRCL) losing 6% and 16% respectively. The shares of the Stablecoin issuer has dropped 40% since it exceeded almost $ 300 on Monday.

Bitcoin miners remained relatively flat during the day, including Core scientist (Corz)that increased more than 30% on Thursday of a report that the hyperscaler of the coreweave was looking to acquire the company, although Hut 8 (CABIN) 6.5%fell.

The slight price action contrasted with the perspective of the White House Rate strategy that is launched again. The president of the United States, Donald Trump, announced that his administration would end all commercial discussions with Canada in the light of the digital services tax that the country aims to impose on US technology companies.

“We will inform Canada the rate they will pay to do business with the United States of America in the next seven days,” Trump published.

The pause in reciprocal rates is also scheduled to end on July 9, but neither traditional markets nor cryptography seem particularly worried, Coinbase analysts pointed out in a research report.

“[Markets] They have largely ignored the potential economic risks derived from this situation … In part because this has not necessarily reflected in economic data, “analysts wrote.

The complacency around tariffs will probably continue, they said, because they are unlikely that they are as inflationary as expected above.