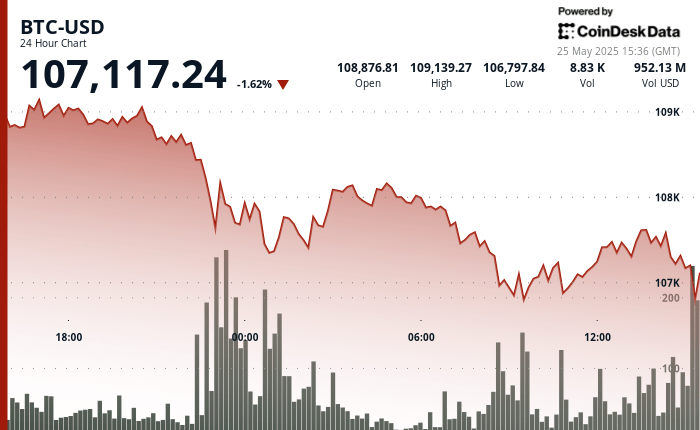

The recent Bitcoin setback has established a strong resistance based on volume about $ 108,300, with training support in the $ 106,700- $ 107,000 area.

The correction accelerated with a notable price of $ 107,373 to $ 107,671 between 13: 06-13: 36, followed by an acute investment.

The technical analysis suggests that Bitcoin is now quoted within a compression zone, trapped between two main fair value gaps that will determine the next market management.

If the Bulls recover the $ 109K to an area of $ 110K, the price could boost the resistance beyond $ 112K, while a break below $ 107,000 could try liquidity around $ 106K.

Technical analysis breakdown

- The decrease accelerated during 22: 00-23: 00 hour on May 24 with an exceptionally high volume (16,335 BTC), establishing strong resistance based on volume about $ 108,300.

- The support has been formed in the area of $ 106,700- $ 107,000 where buyers arose during the period 09: 00-10: 00 on May 25, although the recovery attempts have been modest with the prices that consolidate around $ 107,500.

- The General Technical Structure suggests a short -term bearish trend with potential for greater consolidation before directional clarity arises.

- Bitcoin experienced significant volatility with a notable price increase of $ 107,373 to $ 107,671 between 13: 06-13: 36, followed by an acute investment that saw that prices decreased to $ 107,393 at 14:00.

- The most substantial price movement occurred during the 13:35 minutes candle where BTC increased almost $ 150 with an exceptionally high volume (148.76 BTC), establishing temporary resistance around $ 107,630.

- The support was formed about $ 107,400 where buyers arose during the final minutes of the period, although the general technical structure suggests a continuous consolidation within the broader correction from the maximum of $ 109,239.

External references