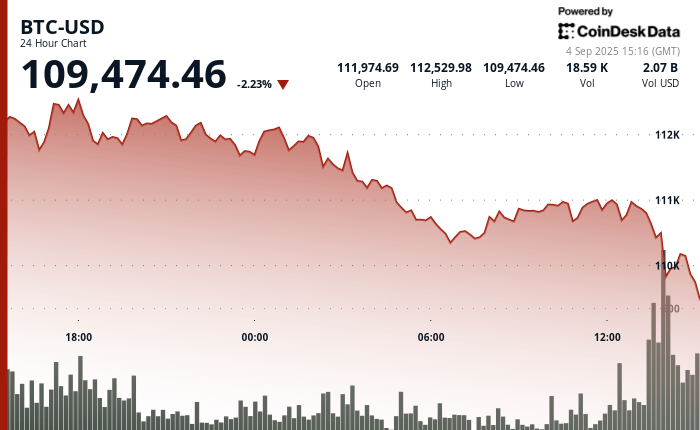

Bitcoin (BTC) The weak rebound this week ran out of gas on Thursday, with prices that recovered below $ 110,000 and some market observers warn about a deeper setback.

The largest cryptocurrency fell 2.2% for 24 hours to $ 109,500, erasing half of the profits it obtained from the minimum of the weekend of $ 107,000, since it exceeded $ 112,600 on Wednesday. Ether (Eth)Solana sun (SUN) and the cardano ada (ADA) All fell more than 3% in the last 24 hours.

The actions of the Treasury of Digital Assets also bleed. BTC’s largest corporate owner strategy (Mstr) It fell 3.2% and is 30% neglected since July. Metaplanet based in Japan (3355) lost 7% and quote 60% lower than its maximum of June, while kind (Naka) He slid another 9% and has now dropped 75% since mid -August. BITS mine -centered vehicles (BMNR) AND SHARPLINK GAMES (Sbet) It fell 8%-9%.

How low could BTC fall?

Concerns about a greater inconvenience are stronger, and some observers point out that September historically is one of the weakest months of Bitcoin and the largest cryptographic market.

At the same time, Gold, the coverage of shelter and safe inflation of the old school, exploded in new records greater than $ 3,500 after a multimantada consolidation, apparently sucking capital of more risky works.

A new Bitfinex report said BTC has entered its third consecutive recoil week since August of $ 123,640. Historically, bull market corrections averaged around 17% peak to minute, suggesting that the market is approaching the typical limit of its reductions, according to the report.

However, there is a risk of a deeper setback, analysts warned. The short -term holder made the price, a new costs of the newest investors in the purchase of BTC, is currently about $ 108,900, less than 1% below the current BTC price. If that level fails as a support, you could open the way to a deeper setback, with a dense supply cluster between $ 93,000 and $ 95,000 that probably provides a lasting floor, according to the report.

Joel Kruger, LMAX Group market strategist, is still more optimistic.

September has generally been a month of consolidation ahead of a stronger performance in the fourth quarter, he said, adding that this year’s correction could be less deep if ETF tickets, corporate treasury assignments and regulatory tail winds materialize.

Read more: Bitcoin Tilt Bearish options before Friday expiration: Crypto Daybook Americas

UPDATE (September 4, 16:00 UTC): Add the BTC supplies cluster table.