The price setback on Thursday in the main cryptocurrencies is probably the result of a long tight or unwilling of leverage calendar plays, instead of a bearish posture.

The Coendesk 20 (CD20) index of the largest and most liquid tokens has lost 6.8% in the last 24 hours, with Bitcoin (BTC), the leading cryptocurrency for market value, falling almost 1% by not having achieved profits greater than $ 120,000. Among the main Altcoins, the ether (eth) fell 3%, XRP (XRP) 13%and Sol de Solana (Sun) 8%.

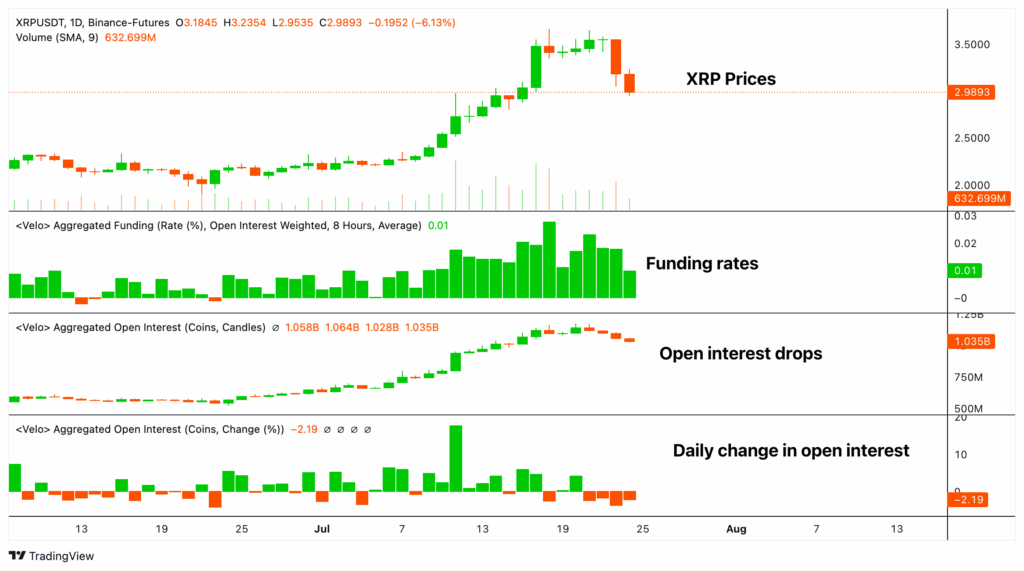

All decreases are consistent with the bearish signals of the technical graphics. They are also characterized by the fall of an open interest in the market of perpetual futures on the high seas and positive financing rates.

For example, open interest, the number of unstable contracts in the futures market, for XRP has fallen more than 6% in two days, according to the veil data source. That is a sign that participants are reducing their exhibition and adopting less risky positions.

The open interest in the future Sun, BTC and ETH has decreased by 5%, 1.5%and 2%, respectively. Velo tracks the activity in perpetuals called in dollars and USDT that appear in Binance, OKX, Bybit and other exchanges.

Meanwhile, financing rates for the four tokens continue to be positive, indicating a net bias for bullish bets. Positive financing rates indicate that perpetuals are quoted with a spot price premium, which requires a periodic payment for a long time to shorts to maintain their open positions.

A long compression is widely seen as a necessary and positive event because “clean” the market by eliminating excess leverage and long positions too optimistic.

The combination of prices drop, the lowest open interest and positive financing rates suggests that bullish bets are actively eliminated from the market.

It describes the probability that the price decrease is backed by investors who take new short or bassist positions because in that case the financing rate would have fallen into negative territory since the headlines of shorts would need to pay the lengths.

In addition, the new shorts would have increased open interest as prices fell, which is not the case.

The decrease in open interest suggests that merchants are closing their positions, a characteristic that leverage longs are settled or voluntarily leaving the market, instead of new shorts that enter the market. Armed, he points out that while the price falls, the feeling is still quite robust.