Good morning, Asia. This is what news is doing in the markets:

Welcome to Asia Morning Briefing, a daily summary of the main stories during the US hours and an overview of the movements and market analysis. To obtain a detailed description of the US markets, see Cryptokook from Coindesk America.

The leverage in cryptographic markets is returning to bullfighting levels, even when last Thursday recoil reminded merchants how overextended bets can relax.

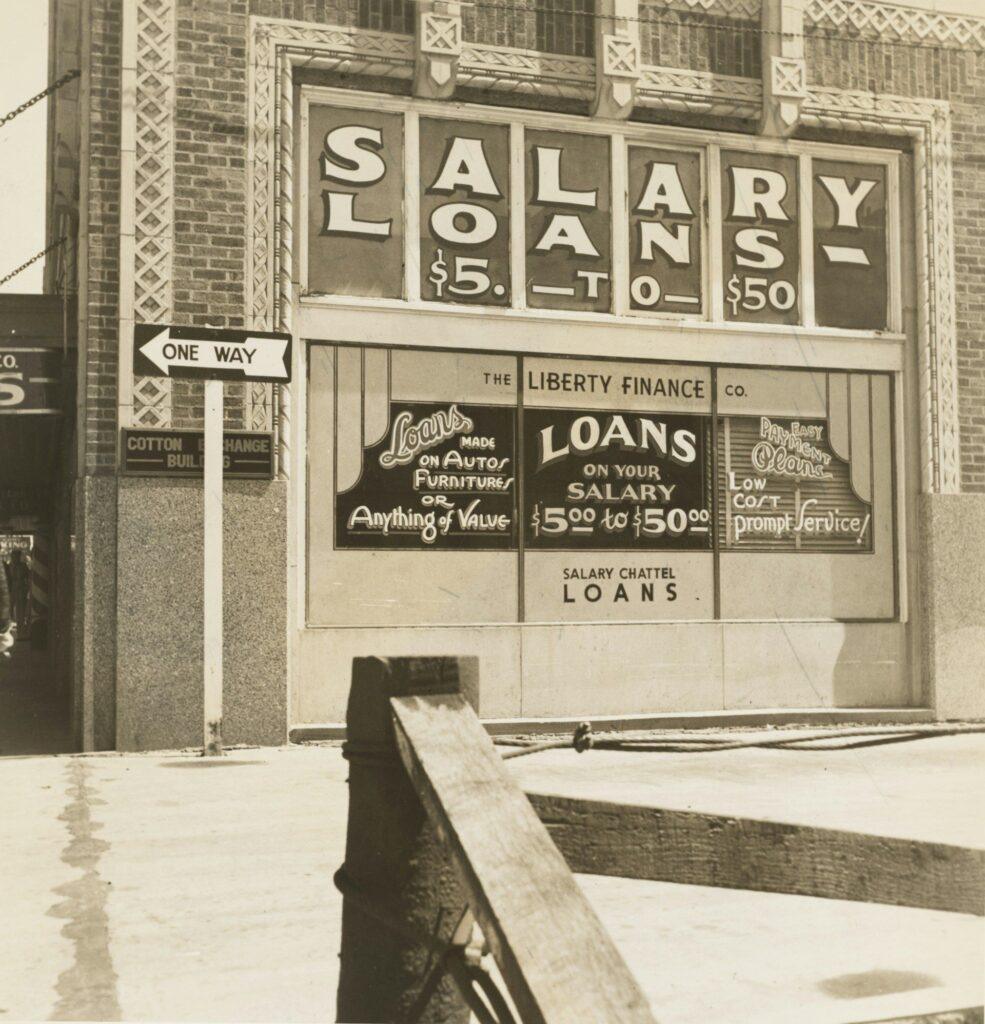

Galaxy Research Q2 Cryptographic Pestary Status It shows crypto-collateralized loans expanded 27% the last quarter to $ 53.1 billion, the highest since the beginning of 2022, driven by record demand in defi loans and an appetite renewed by risk.

That backdrop prepared the stage for last week.

Bitcoin withdrawal from $ 124,000 to as low as $ 118,000 triggered more than $ 1 billion in liquidations through cryptographic derivatives, the largest long elimination since the beginning of August. The analysts framed him as a healthy earnings instead of the beginning of a reversion, but stressed how fragile the market becomes when the leverage develops so quickly.

Galaxy analysts argue that stress points are already visible.

In July, a wave of retreats on ETH indebted rates pushed above Ethereum’s rethink yields, breaking the economy of the popular “loop” where the ETH staked is used as a guarantee to borrow more ETH. The relaxed caused a hurry to get out of betting positions, sending the exit tail of the Ethereum beacon chain to a 13 -day record.

Galaxy has also marked that the costs of loans for the USDC in the free sale market have been uploading since July, even when loan rates in the chain remain flat.

The propagation between the two has been extended to its highest level since the late 2024. This disconnection suggests that the demand for dollars outside the chain is exceeding liquidity in the chain, creating a mismatch that could amplify volatility if the conditions are further adjusted.

With the institutional demand and ETF inputs that still support the bullish backdrop, strategists remain constructive with cryptography.

But among the volumes of balloon loans, the loan power concentration, the defi liquidity abdominals and a wide gap between the dollar markets in chain and outside the chain, the system shows more stress points, writes Galaxy.

The discharge of $ 1b on Thursday was a warning that the return of leverage is cutting both ways.

Market movements

BTC: Volatility has become the markets before Jackson Hole’s speech from Jerome Powell, with merchants who bet on September rate cuts, but some warned complacency could mask the risks as BTC quotes $ 118,061.51, 0.44%more.

ETH: A $ 3.8B record in ether is in a tail to unnecess with a 15 -day wait, adding a potential pressure to obtain profits even when ETF and the demand of the treasure increase, with ETH that quotes at $ 4,524.10, an increase of 2.13%.

Gold: The gold is quoted at $ 3,332.95, 0.11%lower, since the US inflation data. Uu cut the feed rate bets and the Xau/USD consolidation of the $ 3,310 key ahead of Jackson Hole’s speech of Powell.

In another part of crypto

- Stablecoin Boom has made M&A objectives of crypt ramps and ramps and ramps, says Vaneck VC (Decipher)

- Why circle and stripes (And many others) They are throwing their own blockchains (Cindenesk)

- Gemini hires Goldmans, Citi, Morgan Stanley and Cantor as main betting corridors for his IPO (Cindenesk)