Bitcoin (BTC) The capitalization carried out, a metric in the chain that measures the value of the coins at the price that transact the last time, has continued to increase even when the spot price falls, which indicates the conviction of investors to the network and an indication of the economic column of the largest cryptocurrency is strengthening.

After crossing $ 1 billion for the first time in July, Glassnode data shows that CAP made is now in a $ 1.05 billion record, despite the fact that the spot price closes around 12% from its historical peak about $ 124,000. Although market capitalization falls as the spot price decreases because prices prices in all coins at the current level, the lid is adjusted only when the coins are spent and reproduced in the chain in the chain.

Under the limit model performed, inactive holdings, long -term holders and lost currencies act as stabilizers, avoiding large reductions even when short -term price action becomes negative. The result is a measure that better reflects the true conviction of investors and capital depth committed to the block chain.

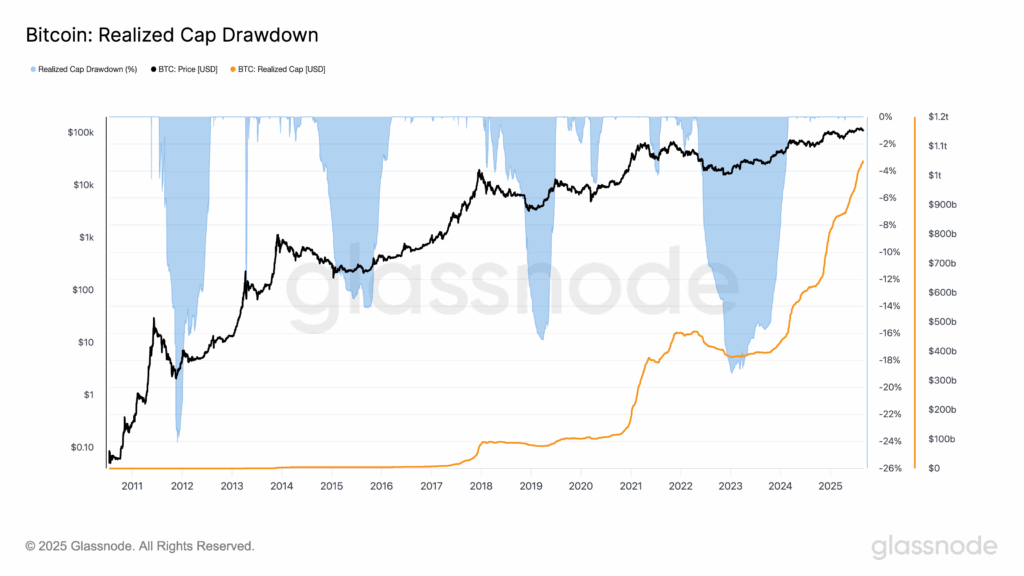

In previous cycles, the CAP performed suffered much more steep delays. During the 2014-15 and 2018 bearish markets, it fell to 20%, since prolonged capitulation forced large volumes of coins to be recruited. Even in 2022, the metric experienced a reduction of about 18%, according to Glassnode data.

This time, on the contrary, the CAP performed is winning despite a two -digit prices correction. This highlights how the current market is absorbing volatility with a much more resistant underlying base.