The number of bullish bitcoins Bets placed with borrowed funds continue to rise on Bitfinex, one of the oldest cryptocurrency exchanges.

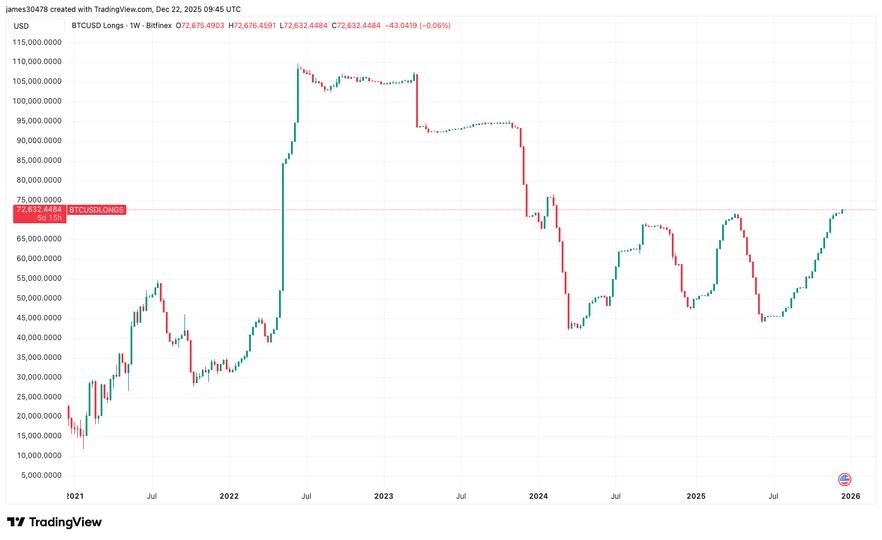

So-called long margin positions have risen to approximately 72,700 BTC, the highest level since February 2024, according to data source TradingView. The account has risen from around 55,000 BTC since October, indicating persistent buying throughout the price drop to $89,000 from over $126,000. At one point in November, prices hit a low of nearly $80,000 on some exchanges.

The accumulation of long exposure highlights confidence among traders even as bitcoin is on track for three consecutive monthly declines, a pattern not seen since mid-2022 during the bear market.

Interestingly, the number of bullish ‘long spread’ bets on Bitfinex has historically been a contrarian indicator for the market. These positions typically peak when the market is in distress and then run out just as a new uptrend begins to take hold.

In previous cycles, a sustained decline in long spreads has coincided with market lows or the early stages of a recovery. This pattern was surprisingly evident during the yen carry trade crash in August 2024, when bitcoin bottomed at around $49,000, coinciding with a sharp reduction in leveraged bets.

A similar dynamic played out during the tariff-driven sell-off in April 2025; As prices fell towards $75,000, the decline in long spreads once again indicated that weaker hands had been shaken out, setting the stage for a subsequent bounce.

For now, the continued increase in leverage suggests that BTC prices have not yet bottomed.