Solana sun

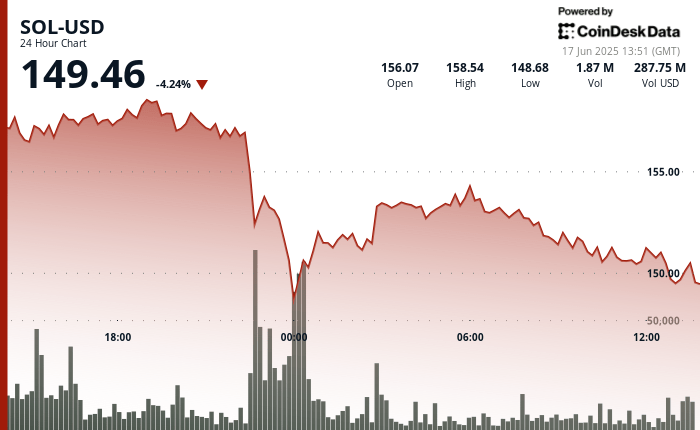

4.24% fell in the last 24 hours to operate at $ 149.46, withdrawing from a maximum of $ 158.54 after a strong sale of the night. The negotiation volume increased when Sol broke below the $ 155 support on Monday night, with the price that finally realized at $ 148.68 before entering an broken consolidation around the $ 150 brand.

Despite short -term pressure, some institutional investors remain optimistic about the long -term positioning of Solana. On Monday, Cantor Fitzgerald launched a coverage of three public companies: Develop Development Corp (DFDV), Sol Strategies (Hodl) and UPEXI (UPXI), which have sun as a treasure asset. The company allocated the three “overweight” qualifications and emphasized the technical force of Solana.

Cantor analysts argued that Solana has surpassed Ethereum in the recent growth of developers and technical performance, citing metrics in the chain that show greater performance and less latency. The report added that companies that use Sol as a treasure asset see it as a serious contender to challenge ETH domain, although Ether still has a market capitalization 2.5 times larger.

While the recent correction has erased much of the weekend’s profits, Sol remains above the support zone last week. Merchants are now observing whether the token can have the range of $ 148- $ 150 or if more down pressure will arise.

TECHNICAL ANALYSIS

- During the analysis window, Sol-USD fell 7.0% of $ 158,804 to $ 147,746, forming a 24.058 points range.

- The sale of more steep advantages occurred between 22:00 and 00:00 UTC by volume greater than 2.7 million sun, decomposing through a support of $ 155.

- The price then stabilized around $ 152 and quoted in an adjustment range between $ 151 and $ 154.

- The $ 152– $ 153 zone went from resistance support during correction, with $ 148.68 marking the low session.

- A 07: 57–07: 58 UTC, the price fell from $ 153,118 to $ 152,680 in a peak greater than 150,000 sun in volume.

- Towards the end of the analysis period, Sol consolidated between $ 153,400 and $ 152,680 with decline volatility, indicating the doubt between bulls and bears.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.