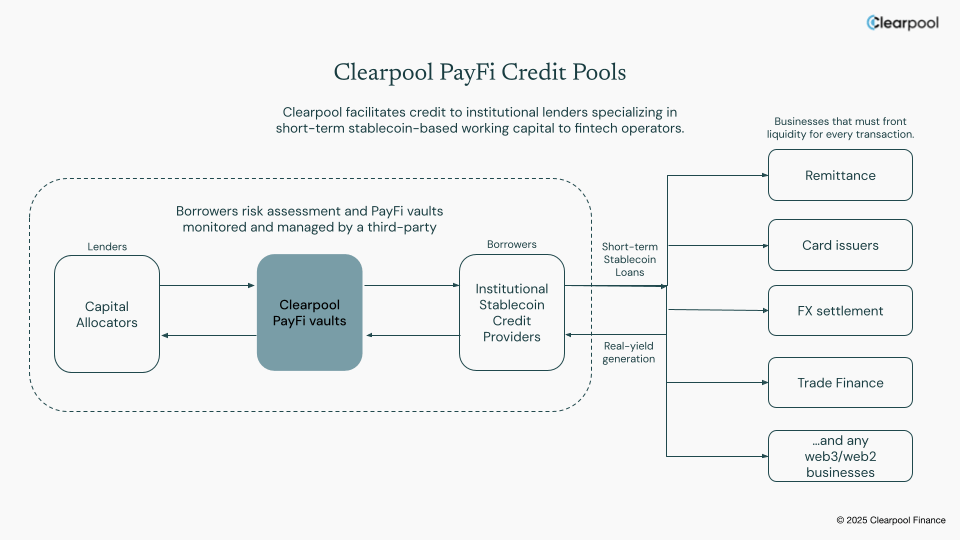

Clearpool, a decentralized credit market, presented a set of products to finance payments, aimed at Fintech companies that process cross -border transfers and card transactions.

Products include Stablecoin Credit Pools for payment finance (PayFI) and CPUSD, a token without permission that generates a short -term loan performance to payment providers.

“What many overlooks is that, although Stablcoins is established instantly, Fiat no, forcing Fintechs to the frontal liquidity to close that gap,” said the CEO and co -founder Jakob Kronbichler on Thursday in a statement.

Clearpool PayFI groups aim to provide credit to institutional lenders that serve these companies, with reimbursement cycles that go from one to seven days.

The Token CPUSD, backed by Payfi vaults and liquid, with Stablecoin yield, aims to deliver yields linked to real world payment flows instead of speculative cryptographic activity.

The expansion of Clearpool underlines the widest trend of the stables that become central infrastructure in global payments, particularly in emerging markets where traditional bank rails remain slow or expensive. The protocol said that it has already originated more than $ 800 million in Stablecoin credit to institutional borrowers, including Jane Street and Banxa.

Read more: PayPal expands cryptographic payments for US merchants to reduce cross -border rates