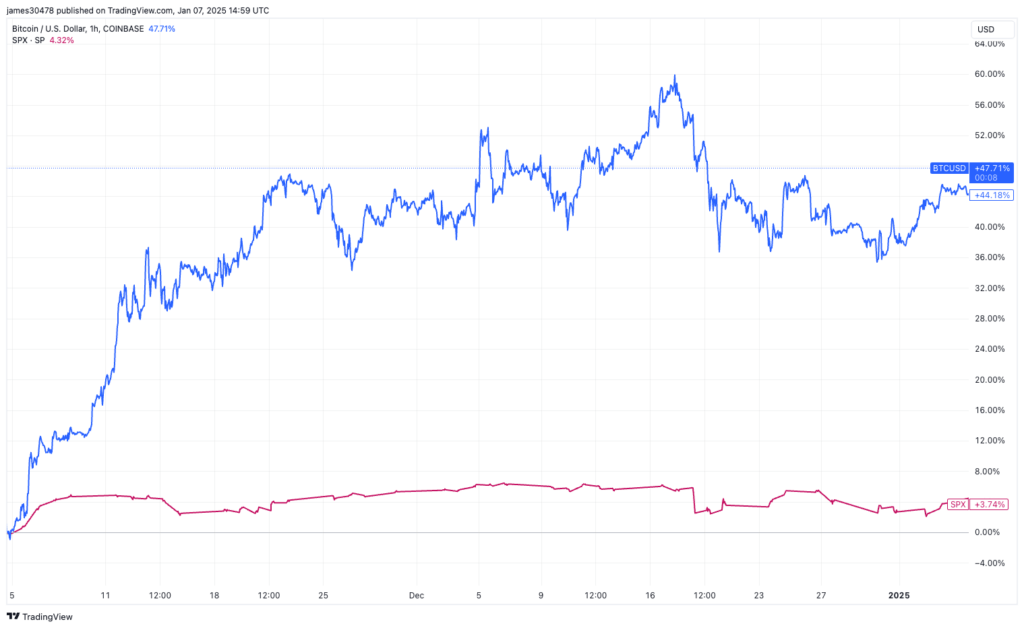

Since Donald Trump’s election to the US presidency on November 5, bitcoin (BTC) has risen about 47%, far outpacing the S&P 500’s 4% gain.

The incoming president, of course, has made clear his sympathy toward bitcoin and cryptocurrencies. It is also worth considering the Republican victory in the Senate and House of Representatives, where laws that could affect cryptocurrencies will finally be passed.

Andre Dragosch, head of research at Bitwise in Europe, spoke exclusively to CoinDesk about other factors affecting the divergence between bitcoin and stocks.

“My view on bitcoin versus the S&P 500 is that the stock market has been negatively affected by the Federal Reserve’s harsh rate cut in December,” Dragosch said. “The Federal Reserve revised its planned 2025 rate cuts to just two rate cuts, less than previously telegraphed and also less than expected by traditional financial markets.”

At the same time, the DXY index, which measures the value of the US dollar against a basket of major currencies, has risen 5%, putting further pressure on risk assets. Typically, that could include damage to bitcoin, but Dragosch explains that it held up relatively well thanks to other factors, including the current bitcoin supply shortfall on exchanges. “Bitcoin exchange balances have continued to fall despite profit taking,” he continued.

However, lately, bitcoin and the S&P 500 have again started to move closely together, their correlation reaching 0.88 (with 0 being no correlation and 1 beginning absolute correlation) in the most recent 20-day moving average.

“While on-chain factors will likely provide a significant tailwind at least until mid-2025, the deteriorating macro outlook could pose near-term risks for bitcoin as well, especially given the still relatively high correlation with the S&P 500.” Dragosch concluded.