Crypto Markets saw an increase in volatility on Wednesday when the aggressive comments of the president of the Federal Reserve, Jerome Powell, shook leverage merchants.

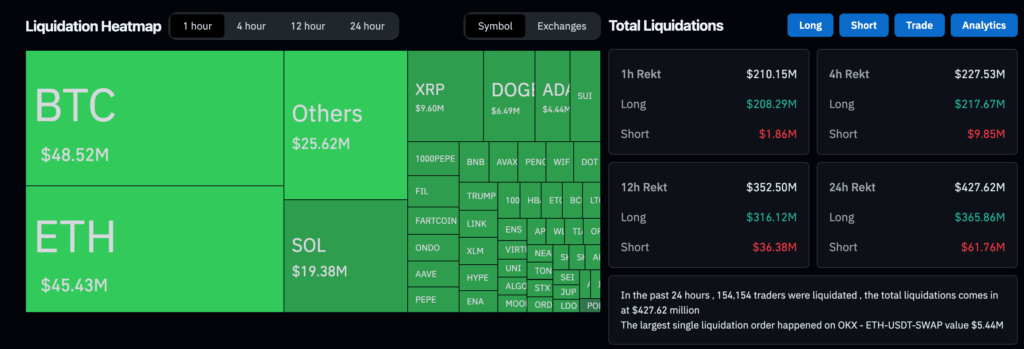

The liquidations increased to more than $ 200 million in one hour in all digital assets, since Bitcoin (BTC) fell below $ 116,000 while Powell spoke, as shown in coinglase data.

The Central Bank left interest rates unchanged, with Powell insisting on possible inflationary pressures of tariffs, while two officials dissected in favor of the cut.

Read more: Bitcoin falls below $ 116k when Jerome Powell offers aggressive comments

Later in the session, BTC recovered above $ 117,000, still 0.8% less during the day and quoting at the lower end of its narrow three weeks. Ethher (ETH) slipped to 3%, then recovered at $ 3,750, modestly lower (-0.6%) in the last 24 hours.

Altcoins recorded the most pronounced descents first, but quickly recovered. Solana’s Sol (Sol), Avax (Avax) of Avalanche and Hyperliquid’s Hype -Tokens fell 4% -5% before passing the losses, while Bonk and Pengu sank 10% each before bouncing.

A check in the traditional market saw a goal (goal) and Microsoft (MSFT) that publishes strong quarterly gains, raising the shares by 10% and 6% higher, respectively, after regular negotiation hours.

“The market is increasingly starting to think that the Fed can be behind the curve,” said Matt Mena, an analyst for the 21SHARS digital assets issuer, in a market note.

“The PCE impression last week marked the second consecutive soft reading, and consumer spending is weakening,” he wrote. “With unemployment that obtains higher and higher yields still restrictive, maintaining such a tight policy runs the risk of opening attention in a broader deceleration.”

The current configuration reminds the last quarter of 2023, Mena said, with “inflation softening, the increase in political volatility and a fed limited by lagged indicators.”

He said that “the scenario is established” so that the fed pivot at lower rates, which could take BTC to $ 150,000 by the end of the year.