Yesterday, on July 30, it was the 10th anniversary of the launch of Ethereum. In the Crypto For Advisors Bulletin today, Alec Beckman of Psalion writes about Ether’s growing role as a treasure reserve asset and highlights growing trends.

Then, Eric Tomaszewski of Green Capital Management answers questions about Ether as an investment in Ask to Expert.

Thanks to our sponsor of this week’s newsletter, Grayscale. For financial advisors: Register for the next Minneapolis event on September 18.

– Sarah Morton

Ethereum: The assault of treasury assets rising remodeling corporate finances

Ether, the cryptocurrency of the Ethereum block chain, is being quickly adopted by public companies as a strategic treasure asset, an evolution that is helping to remodel corporate finances and change the dynamics of the eth market.

Bitcoin has long dominated the digital treasure conversation. Its limited supply and its decentralized nature make it a coverage against inflation and a value reserve. Ether is updating, thanks to its potential for performance, economy, real world utility and mature institutional infrastructure.

Why Ethereum appeals to Treasury Bonds

Ethereum’s transition from 2022 to the participation test allowed holders to obtain annual rethinking yields between 2% and 4%, creating a layer of passive income that Bitcoin does not offer. The asset has also been deflationary sometimes, with more ETH burned than the issued, supporting a thesis of the value store.

At the same time, Ethereum feeds an ecosystem of decentralized applications, tokenized assets and intelligent contracts. For corporations, it can work not only as a reserve asset but also as capital to implement services and infrastructure.

The treasure wave eth

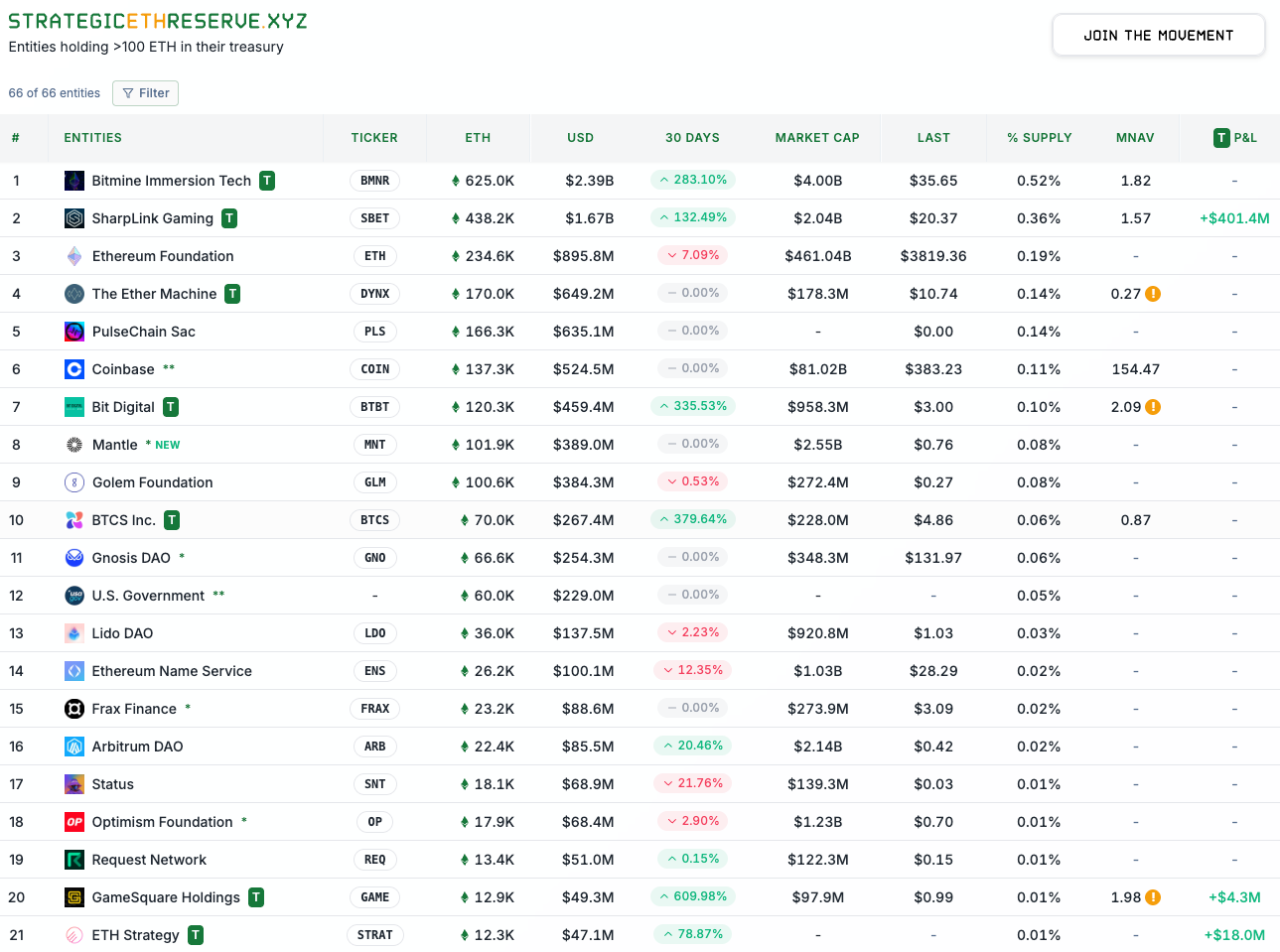

Several public companies are now building treasury strategies around ETH, following the first engines such as Microstrategy in Bitcoin:

- Digital bit It has more than 120,300 eth and bets all its allocation. The CEO Sam Tabar is called a “steering wheel model”, where performance fund operations. They plan to add more to the melody of> $ 1b.

- BTCS Recently it increased its participations to more than 70,000 ETH and was one of the first public companies to make ETH as a treasure strategy.

- Bits mines immersion Its objective is to acquire 5% of ETH total supply. Backed by significant financing and directed by Tom Lee, it now has more than 625,000 ETH.

- Sharplink Gaming It has more than $ 1.67 billion in ETH, adding almost 80,000 coins in a single week and pursuing the reference as a central strategy. Joe Lubin is a member of the Board and manages its ETH acquisition strategy.

- Gamesquare It has allocated $ 30 million in ETH with the approval of the scale at $ 250 million. It also plans to integrate the performance based on defi and NFT as differentiating. Gamequare sees the Ethereum Network as Manhattan, with a Financial District (Defi), an art district (NFT) and more. Investing in it today is essential for future value and use.

- The ether machineA vehicle backed by Spac left Dynamix that quotes on the stock market, points to $ 1.5 billion in ETH while preparing to go over.

Companies listed especially plan to add significantly more. Other companies have just announced their holdings, such as Ethzilla.

These companies not only buy … They are pointing to long -term conviction and, in many cases, build income and income flows directly in Ethereum. An example is Gamequare, whose strategy is closely aligned with its audience in the games, media and entertainment industries and sees the connection with the products in the Ethereum -based chain. It is important for them to promote financial alignment with their audience.

BTCS is implementing a similar strategy to align with its audience, since the construction of blocks and references create a vertical pile in the Ethereum network, which results in efficiencies in transactions and the rethinking.

The demand supply imbalance

The ETH price has constantly increased in recent months, and the purchases of the public company are one of the main catalysts for this increase. In a recent 30 -day period, 32 times more was acquired eth of what was issued. That includes the purchase of treasury assigned, newly approved rethinking and ETF vehicles. A continuation of this trend will create an offer shock.

Unlike Bitcoin, where miners must often sell their bitcoin to cover the operating costs, the change of Ethereum to the stagy test reduces the pressure on the side of the sale and aligns to the holders of obtaining the network.

Conclusion

Ethereum is no longer just a platform for developers; It is now a financial asset that public companies are adopting on a scale. With the incorporated performance, deflationary dynamics and the increase in institutional demand, ETH is emerging as an cornerstone of the corporate treasure strategy. As more companies go from “interested” to “assigned”, this new wave of ETH buyers can help define the following phase of the cryptographic cycle.

Special thanks to Sam Tabar, CEO of Bit-Digital, Charles Allen, CEO of BTCS, Justin Kenna, CEO of Gamesquare and Rhydon Lee, managing partner of Goff Capital (affiliated to Gamamare) about sharing his ideas with me in Eth Treasury Companies, Differenciation and The Ethereum Network in general.

– Alec Beckman, Vice President of Growth, Salion

Ask an expert

Q: Why is ETH discussed as a strategic reserve asset?

TO: Ethereum has silently become financial infrastructure, not just a speculative asset.

Unlike Bitcoin (which is mainly a “value warehouse”), ETH feeds a real economy that links intelligent contracts, tokenized assets, stablecoin transactions and decentralized financial services. As more economic activity is established in Ethereum, ETH is being considered a reserve asset by institutions, Fintech, DAO and even sovereign actors.

The reason is that ETH is the fuel that makes the system work. It is similar to maintaining oil in an energy economy or treasury in a system of dollars.

Q: Should corporate treasure bonds treat ETH as an equivalent capital in cash and long -term technology or a form of intangible infrastructure?

TO: In practice, I see this as a new manga in the portfolio that would call a “digital infrastructure reserve”. It has beta and technological regulatory risks, but also offers operational utility (deposit in intelligent contract, settlement, tokenization rails). That is neither effective nor capital.

Q: How does “ETH as a strategic reserve” translate into practical implications?

TO: For institutions and treasury bonds:

- ETH serves as an effective and guarantee to execute businesses in the chain.

- It generates performance (bet) such as invoices T.

- It remains in balances, declares in treasure policies and audits.

For individuals and families:

- ETH is treated as a long -term strategic asset.

- Carefully assigned (at least 1-5%) and separated from short-term needs.

- It is used to obtain rethinking income, coverage against fiduciary devaluation and obtain exposure to the growing Ethereum role in finance and tokenized infrastructure.

Q: What would demonstrate that ETH deserves to be treated as a serious reservation asset in the next 10 years?

TO: If more of the world’s financial activity, such as Tokenized Real Estate, Stablecoins and large international payments, they are settling directly in Ethereum, it shows growing network confidence. As Ethereum becomes central infrastructure for the transfer of global value, ETH passes from speculation to a legitimate strategic reserve.

Strategicethreshreve.xyz is a great source to measure progression. Beyond that, it is useful to see the innovation and creativity of names such as Robinhood and the Ether machine, to name a few.

– Eric Tomaszewski, Financial Advisor, Green Capital Management

Continue reading

- The White House published its first digital asset policy report on Wednesday, July 30.

- Billionaire Ray Dalia recommends exposure to 15% of Bitcoin in portfolios to protect against Fiat degradation.

- Samsung has associated with Coinbase to integrate cryptographic payments for Samsung users.