The Terawulf Cryptography Mining Firm (Wulf) plans to raise $ 3 billion in debt to expand its data centers operations in an agreement backed by Google, as the AI infrastructure arms race intensifies.

The company, Bloomberg reports that the CEO of Terawulf, Patrick Fleury, is working with Morgan Stanley to organize the financing, which could be launched as soon as next month through high -performance bonds or leverage loans.

Credit rating agencies are evaluating the agreement, and Google support can help ensure a stronger credit rating than would be typical for the company.

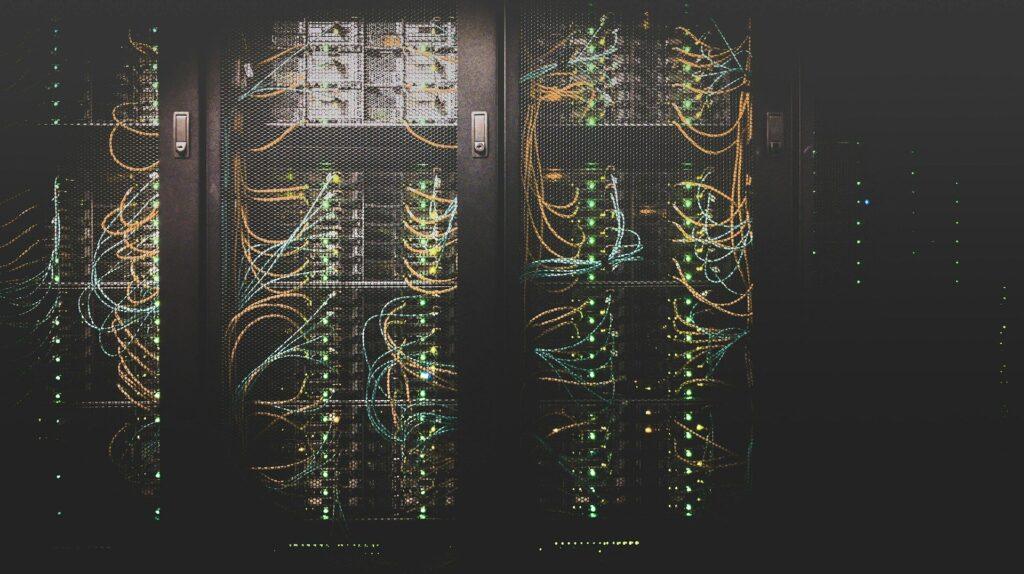

The hunger of the AI industry for the space of the data centers, the chips and the electricity has attracted the unlikely partners of the cryptographic miners, which already control the intensive energy infrastructure that can be reused for the workloads of AI.

Google, which recently increased its support for Terawulf to $ 3.2 billion, now has a 14% participation in the company. That support helped AI Cloud Platform Fluidstack to expand its use of a data center managed by Terawulf in New York in August.

Other crypto-national companies are following their example. Cipher Mining reached a similar agreement with Google and Fluidstack this week. Google will also be delayed $ 1.4 billion in obligations linked to that agreement and take a capital participation in encryption.

Terawulf’s shares fell around 1.3% in Friday’s negotiation session and did not change at trade away.