The draconian cryptographic regulation that prevented US citizens from benefiting from Airdrops, a way of rewarding user communities through the distribution of free tokens, has cost the Americans up to $ 2.6 billion in potential revenues and the government up to $ 1.4 billion in lost tax revenues in the last four years, according to the Dragonfly Risk Capital company.

In a report published on Tuesday, the company centered on digital assets presented a range of figures, based on a sample of 11 main aerial airplanes that generated more than $ 7.16 billion since 2020. The list includes the tastes of 1 inch, Eigenlayer, Arbitrum, Athena, Optimism and Layerzero. It was discovered that the average claim for eligible address involved in these Airdrops was $ 4,562.

“We realized that there is a real need for data that can really show the effect of regulation by application and how these policies impact people, the economy in general and the United States government,” said Dragonfly’s associate general advisor Jessica Furr in an interview. “So we decided to focus on Airdropps as a case of discreet use of Crypto to see how current policies may have created some negative externalities.”

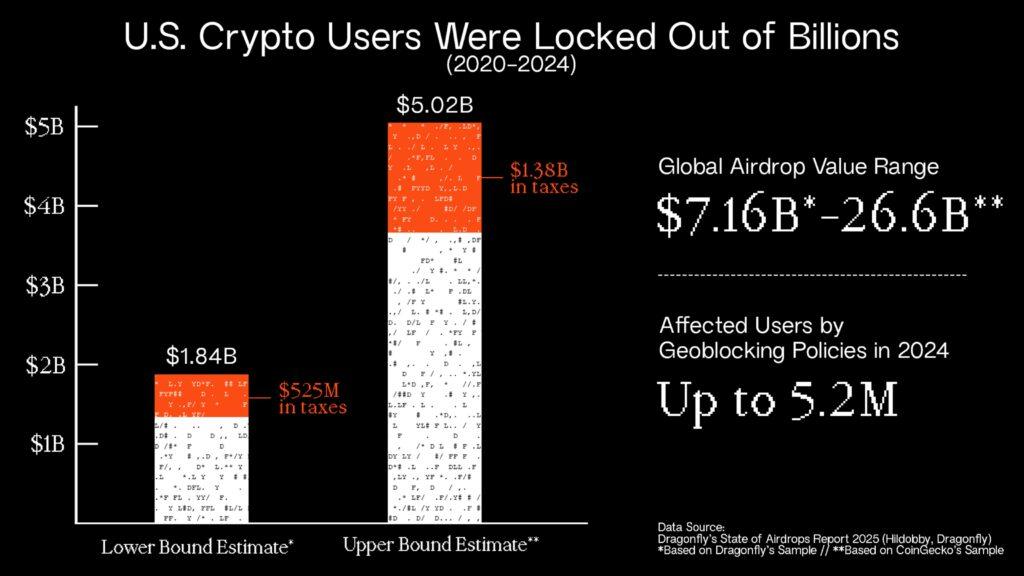

The report estimates that between $ 1.84 billion and $ 2.64 billion in potential revenues were lost to US users from 2020 to 2024 due to geobloqueo, a technique of US IP addresses.

The figures can be even higher. Using a larger sample of 21 GEOBLOKED AIRDROPS analyzed by Coingcko, Dragonfly found that lost potential revenues for US residents could have been between $ 3.49 billion and $ 5.02 billion since 2020-2024.

Years of regulatory uncertainty in the United States have had a chilling effect on cryptographic innovation, scaring new companies on the coast, while larger companies have been attended with citations and have dedicated themselves to demands with regulators.

In addition to Blockchain builders, risk capital companies such as Union Square Ventures and Andreessen Horowitz were also attacked by the SEC to invest on platforms such as Uniswap, which Dragonfly’s report cites as the last main plane that should not be geoblocated in the United States.

Dragonfly is not the only risk capital company in highlighting US geoblocation: Variant Fund in the city of New York also produced a report that analyzes how cryptographic companies have no other option than the forceful tool of simply excluding all Americans for fear of being attacked by regulators.

“If the rules are not clear about what the projects can do, only Geoblock becomes better to avoid getting into trouble,” said Furr. “Being to an expensive dispute where you have to defend can close projects because they cannot pay that invoice.”

Almost a quarter of all active crypto addresses worldwide are controlled by US residents, and the number of users in the United States since 2020 amounts to about 5.2 million, according to the report. The figure excludes those who reuse virtual private networks (VPN) to overcome geofencing measures.

Dragonfly also reached the estimated tax revenues due to the geoblocated income of Airdrop between 2020 and 2024, which is set for between $ 525 million and $ 1.38 billion in personal and corporate taxes.

Update (March 11, 16:00 UTC): Add lar Airdrop Sample size data in Cindeko in the fifth paragraph.