Las Vegas-The financial advisors in the US. UU. They are committed to funds (ETF) quoted in cryptocurrency exchange and are ready to increase their holdings this year.

During a presentation at the Exchange Conference in Las Vegas, the TMX Vettafi Head of Research, Todd Rosenbluth, and the Senior Investment strategist, Cinthia Murphy, presented results of a survey sent to thousands of financial advisors in the United States, arguing that Crypto is “part of the conversation of all today.”

The results showed that 57% of the advisors plan to increase their assignments in cryptographic ETF, while 42% will probably maintain their position. Only 1%, practically no one, wants to reduce its position.

“I think that last year the message was that it is a risk of reputation. Today, there is no advisor who at least cannot maintain a basic cryptography conversation,” Murphy said.

Although the US Securities and Securities Commission (SEC) approved the ETF Spot Bitcoin in January 2024, a year before the president of the United States, Donald Trump, assumed the position, the enthusiasm of the new administration of the cryptographic industry has probably promoted its broader institutional adoption. Regulators, including the SEC and the Basic Products Future Trade Commission (CFTC), have reversed Crypto’s course since the beginning of Trump’s presidency, indicating a more friendly and clearer regulatory approach.

Respondents said they are particularly interested in cryptographic capital ETFs, which are funds that invest in companies that are quoted in the stock market with exposure to the cryptographic industry, such as the strategy (previously Microstrategy) or Tesla.

“You can’t maintain the space that I think explains why cryptographic equity has been popular because it may be a little easier to understand and put its fingers around it,” Murphy added.

Since Trump took the Oval office, MSTR actions of Michael Saylor have seen a more than 100%rally, which makes cryptographic actions more lucrative for retail and institutional investors. Mstr’s actions have reduced some of their profits since they reached the maximum of all time; However, the results of the survey seem to suggest that it is still attracting interest from all parts of the market.

ETF spot and multiple token

ETF linked to cryptographic equity are not the only ones who gain impulse with financial advisors. About 22% of respondents said they are looking to assign capital to detect cryptographic ETF, such as ETF Spot Bitcoin (BTC) or Spot Ether (ETH).

The third largest group, that around 19% of respondents said they were interested, were cryptographic asset funds containing multiple tokens.

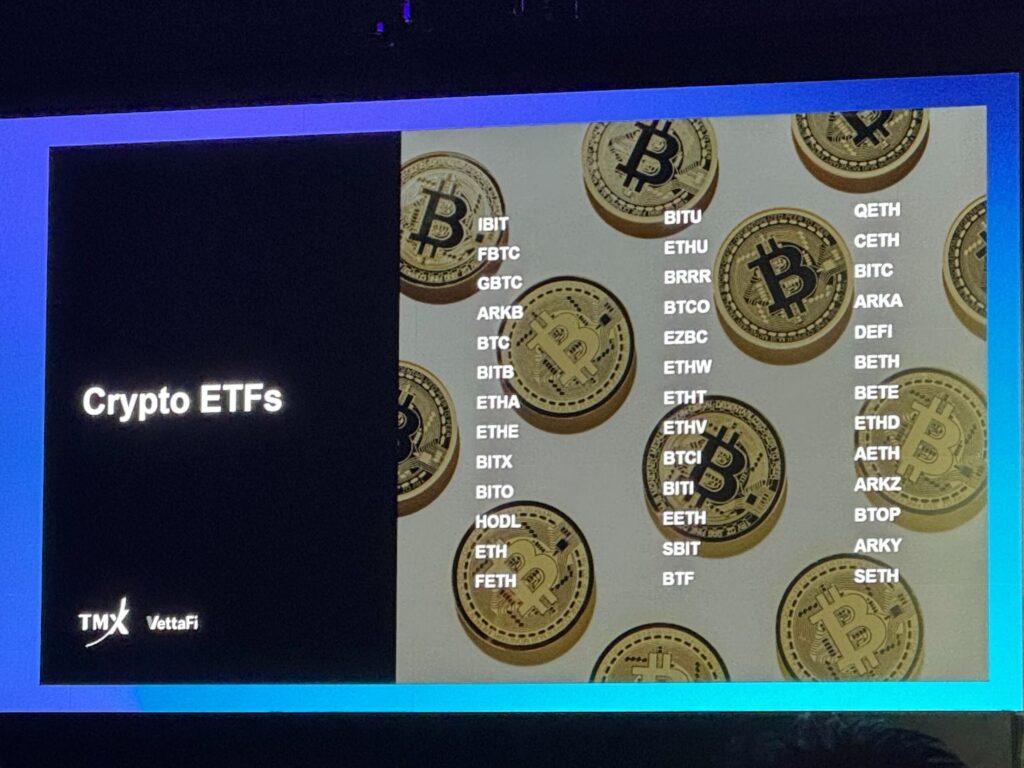

There are numerous cryptographic ETFs that are negotiated in exchanges, with several more in the process of receiving the approval of the SEC that will be listed in the future.

The last months have seen a particularly large amount of ETF based on indices, which means they have a basket of cryptographic assets behind Bitcoin and Ether. Other releases have included administered funds that provide downward protection for pricing volatility by assigning a percentage in the United States Treasury Bonds, for example.

Several emitters have been presented to carry more ETF cryptographic spot, including Solana (Sol), XRP and Litecoin (LTC), but the SEC has not yet reviewed.

“This is a space that is only growing, and I recommend that you know the experts in space … because this is moving fast and there is much to learn,” Murphy said.

Cheyenne Ligon contributed to the story.

Read more: Credo Regulatory Clarity Top Catalyst for industry growth: Coinbase and EYP survey