Since President Trump was inaugurated on January 20, Bitcoin (BTC) has fallen from $ 109,000 to $ 80,000, which makes it a classic event “sell the news.” The correction has continued from the Digital Asset Summit on Friday.

While the price action can dictate the short -term ostentation, Bitcoin Bulls could see it as a long -term positive catalyst, since the US administration has changed a hostile position under the administration prior to a more favorable. However, the lack of immediate purchase pressure suggests short -term weakness.

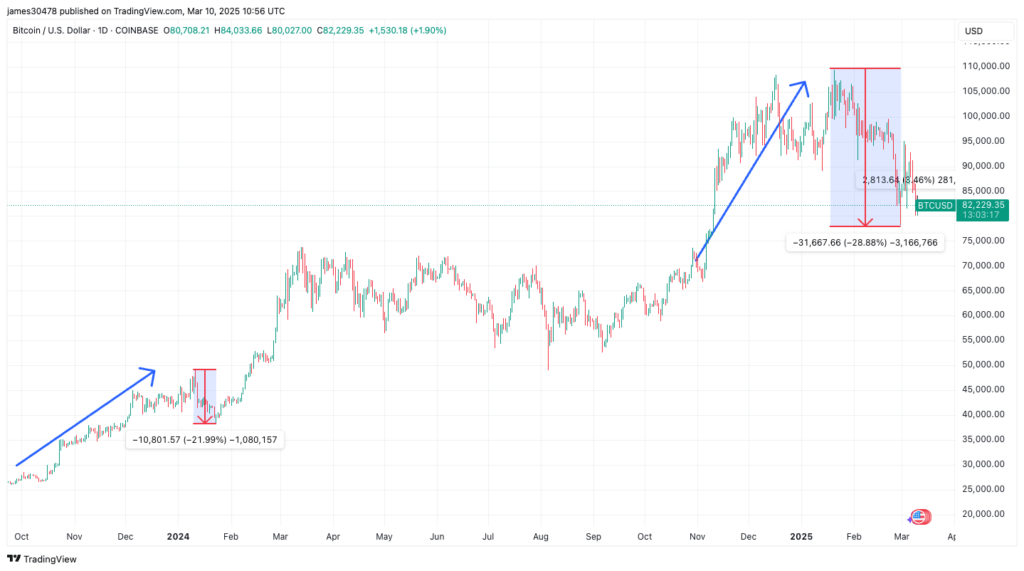

A similar price action occurred during the long -awaited launch of the US Bitcoin Spot. UU. In January 2024. From October 2023 to January 2024, Bitcoin increased from $ 25,000 to $ 49,000, more than 40%. However, the launch marked a local top, since the price subsequently decreased by 20% during the following weeks before finally reaching new historical maximums above $ 73,000 in March.

This time, after President Trump won the US elections in November, Bitcoin recovered from 60%, reaching a historical maximum of $ 109,000 in January before undergoing a correction of almost 30%.

The common pattern in both cases is that the upward news triggered a local top in the price of Bitcoin, followed by significant correction. The next variable is that Bitcoin will begin to move higher after this correction is over, very much depending on the macro panorama.