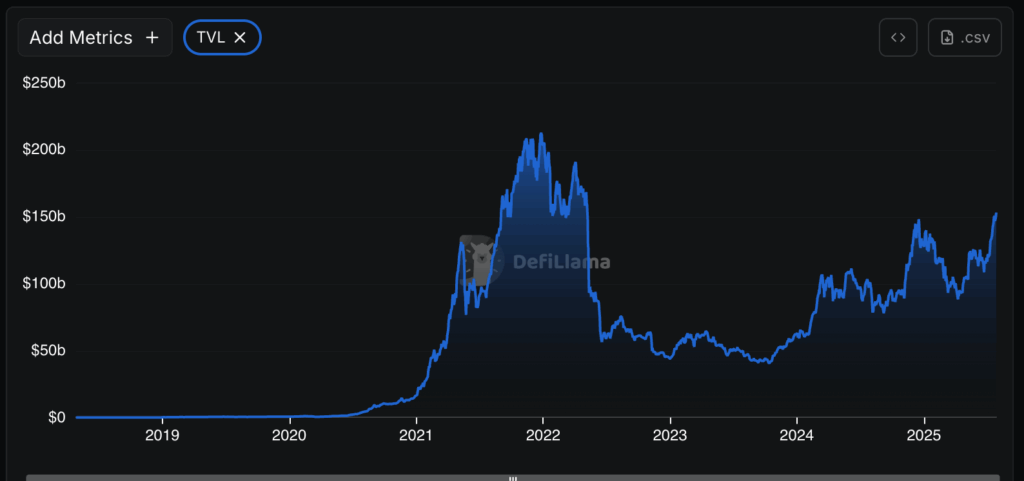

The Decentralized Finance Market (DEFI) shot at a maximum of three years of $ 153 billion on Monday, stimulated by the rise of ETH to $ 4,000 and significant tickets in the replacement protocols.

Defillama data show that the increase in entrances and prices of assets during last week raised the sector above its high point in December 2024 to its highest point from May 2022, at the time of a collapse of $ 60 billion do Kwon’s Terra Network.

ETH has increased 60% of $ 2,423 to $ 3,887 in the last 30 days after an institutional investment wave that includes a treasure investment of $ 1.3 billion of Sharplink games and the acquisition of $ 2 billion bitmine.

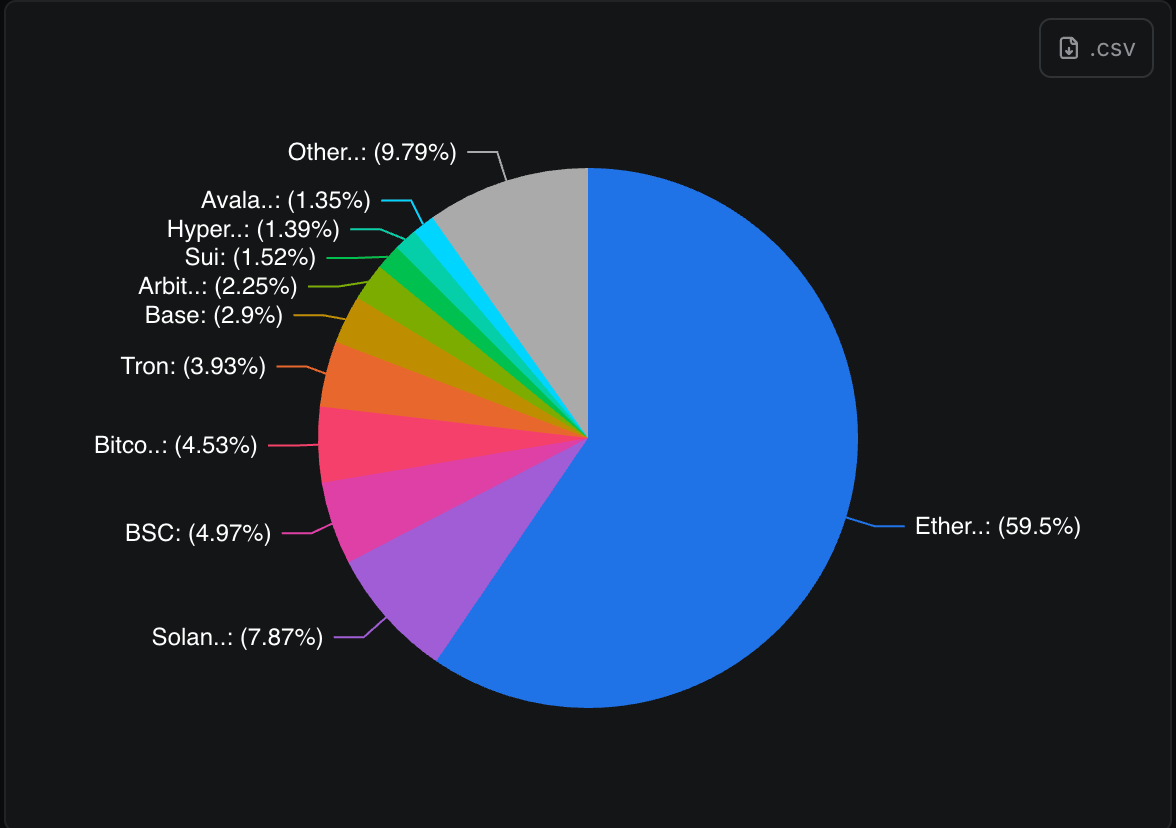

Ethereum still orders the monopoly on the total value of Defi blocked (TVL) with 59.5% of the entire capital blocked in the chain, most of which can be attributed to the Lido liquid bet protocol and the Aave loan platform, which have between $ 32 billion and $ 34 billion in TVL.

The battle of performance agriculture

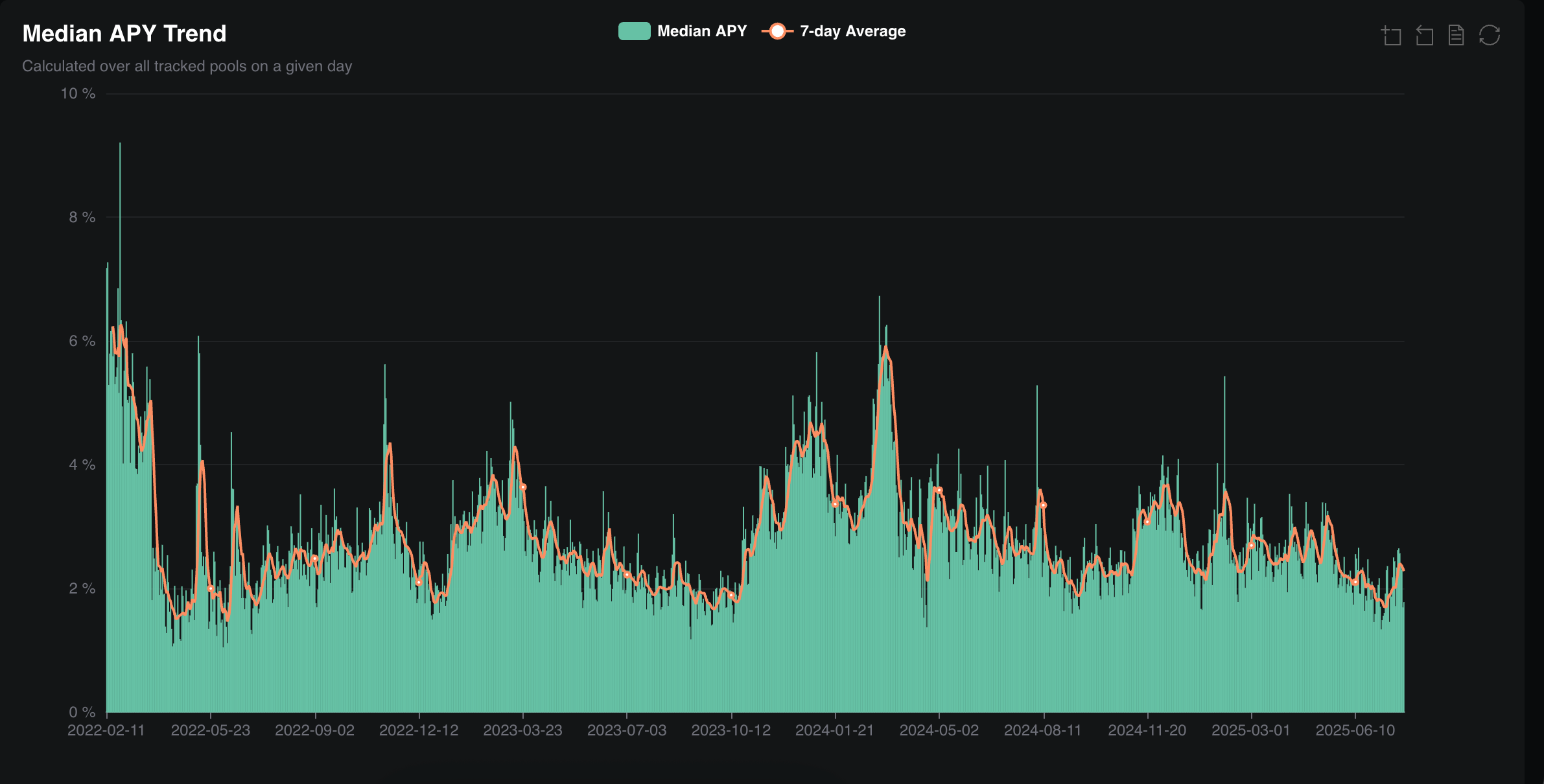

Institutions that acquire assets such as Ether are part of the equation, the other is ensuring performance in addition to that investment.

Investors can bet on ETH directly and obtain a modest annual yield between 1.5% and 4%, or they can go one step further and use a replacement protocol, which will grant a native performance and a liquid bet token that can be used in another part of the defi ecosystem to obtain additional performance.

X User Olimpiocrypto revealed a more complex strategy that can ensure annual performance of up to 25% in USDC and SUSDC with low risk and complete liquidity. Red assets between Euler and Spark in Unichain: Users supply USDC in Euler, they borrow their DC, they again supply and repeat it. SPARK Incentives (SSR + OP REWARDS) and EUER (USDC Subsidies, Reul) Boost Returns.

An easier but less profitable alternative begins by accommodating SUSDC through spark and loan with a loan/loan of USDC in Euler. Despite the discrepancies of the user interface, according to reports, both methods are producing strong yields, it probably lasts approximately one week unless the incentives change.

Solana and other blockchains

While much of the attention is understandably in the Ethereum Network, the Solana TVL has grown by 23% in the last month to $ 12 billion, with protocols such as Sanctum, Jupiter and Marinade exceed the wider sun ecosystem with significant entries, according to defill.

Investors have also been investing capital in Avalanche and Sui, which rise 33% and 39%, respectively, in terms of TVL this month. The Bitcoin Defi ecosystem has been more silenced, increasing in just 9% to $ 6.2 billion despite a recent impulse to new records of $ 124,000.