Dogecoin increased more than 7% in the last 24 hours, promoted by more than $ 200 million in whale purchases and an acute increase in derivative positioning. The memecoin crossed the resistance level of $ 0.25, causing a rupture led by volume and sending open future interest above $ 3 billion. The property of the big holders now has only 50%, which underlines the growing institutional participation.

Technical patterns suggest more up to the $ 0.27 area, with an intact upward feeling.

News history

- The accumulation of whales crossed one billion dogada tokens (with a value of $ 200 million) in the last 24 hours.

- The property of the great headlines approached 50%, a threshold approached for the last time during the previous tops of the market.

- Doge Futures Open Interest exceeded $ 3 billion, indicating a strong return of leverage positioning.

- The widest force of the cryptocurrency market supported the rally, with a risk feeling driven by shares of the sharing market.

Summary of the price action

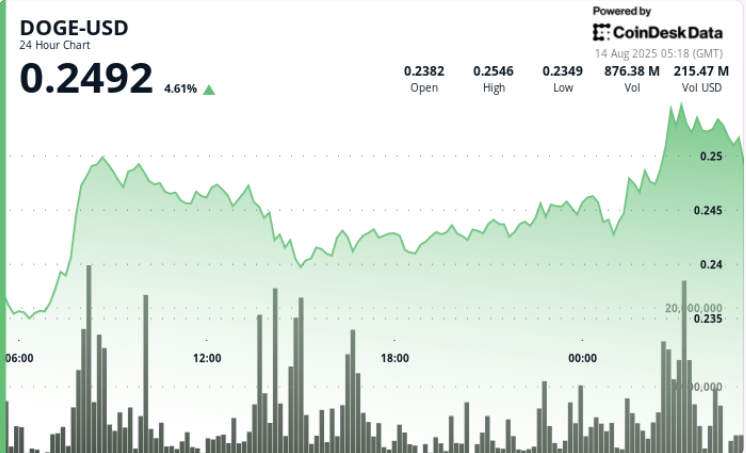

- Doge recovered from $ 0.24 to $ 0.25 in the 24 -hour period from August 13, 05:00 to August 14 04:00 (+7%).

- The negotiation range covered $ 0.24– $ 0.26, which reflects 9% intradic volatility.

- The rupture above $ 0.25 occurred in the afternoon after the previous consolidation.

- The volume during the phases of rupture significantly exceeded the daily averages, reaching a maximum of 29.2 million in a single minute.

- The final time showed stabilization at $ 0.25 after the brief setback.

Technical analysis

- Breakout for short -term bullish flag patterns projects about $ 0.27.

- $ 0.25 now acts as a new support after multiple successful re -stimming.

- The resistance is $ 0.26, with a clean movement above the opening route to $ 0.27.

- The volume profile indicates a strong accumulation instead of a speculative rotation.

- OI futures and financing rates suggest sustained long positioning in the short term.

What merchants are seeing

- Support capacity of $ 0.25 to maintain during any intimate setback.

- Breaks above $ 0.26 to confirm the continuation of $ 0.27.

- The wallet flows to obtain signs of continuous accumulation.

- Financing rate peaks that could indicate overpopulated long.

- Correlation with broader risk movements in actions.