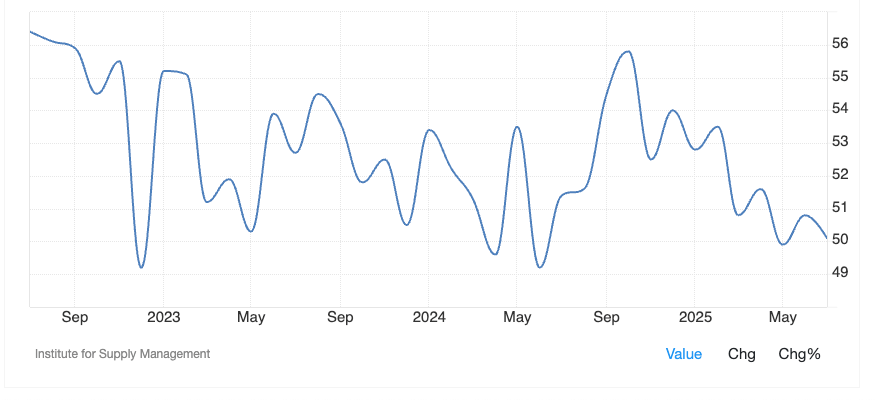

In addition to the shocking growth reviews on Friday, which sent the prices of cryptocurrencies fell, the ISM PMI Services is suddenly beginning to constantly indicate the softer economic activity than it is.

ISM services for July reached 50.1, considerably lower than the expected 51.5. A number greater than 50 indicates economic expansion, and below that level of contraction.

The soft impression is remarkable since it is now a pattern of weakness of three months, and the May number has been 49.9 and June 50.8, a considerable deceleration of the previous months.

Composed of this sign of economic weakness was a staked signal integrated in the report, prices paid subscript, which were shot up to a cycle of 69.9.

“Tariffs are causing additional costs as we continue buying equipment and supplies … The cost is significant enough to postpone other projects to accommodate these changes in costs,” said a comment from the report.

Neither the cryptography nor the traditional markets kindly took the data on Tuesday, with Bitcoin (BTC) withdrawing from more than $ 114,000 to $ 112,800, lower in almost 2% in the last 24 hours. The Nasdaq invested profits prior to a loss of 0.5%.

Fed cut now?

“The data always suffer great reviews when the economy is at a turning point, as a recession,” economist Mark Zandi wrote after the great review of jobs down on Friday.

“The economy is in the precipice of the recession,” he continued. “Consumer spending has planned, construction and manufacturing are hired, and employment will decrease. With increasing inflation, it is difficult for the Fed to come to the rescue.”

Hoishington Management’s lifelong managers, Lacy Hunt and Van Hoisington are not so sure that Fed can wait. Calling inflation profits of temporary rates and a first round effect, Hunt and Hoisington say that the second, third and posterior contracts are of much more importance.

“The Fed must quickly advance to a well -off policy,” they concluded. “The Fed will not be advised to wait … the much more critical consideration is the next contraction in global economic activity.”