Dogecoin recovered on Tuesday after a series of regulatory and corporate catalysts changed the feeling throughout the cryptographic sector. An acquisition of $ 50 million linked to Trump of a Minera de Doge firm, the launch of Wyoming of a stablecoin backed by the State and comments from federal reserve officials that indicate a softer position on digital assets converged to trigger new institutional flows.

News history

• Thumzup, an entity affiliated with Trump, acquired Degehash for $ 50 million, creating what executives described as the largest Mining Operation. The agreement indicates pocket confidence in Dogecoin infrastructure.

• Wyoming presented the stable border token, the first state stable backed by the government, reinforcing the regulatory pivot of the United States towards digital assets.

• The Vice President of the Fed, Michelle Bowman, warned banks about competitive risks by delaying the adoption of digital assets, indicating a more crypto-acomoda position.

• Sofi Technologies integrated the Bitcoin Lightning Network, aimed at the remittance market of $ 740 billion, another deeper traditional finance signal in cryptographic rails.

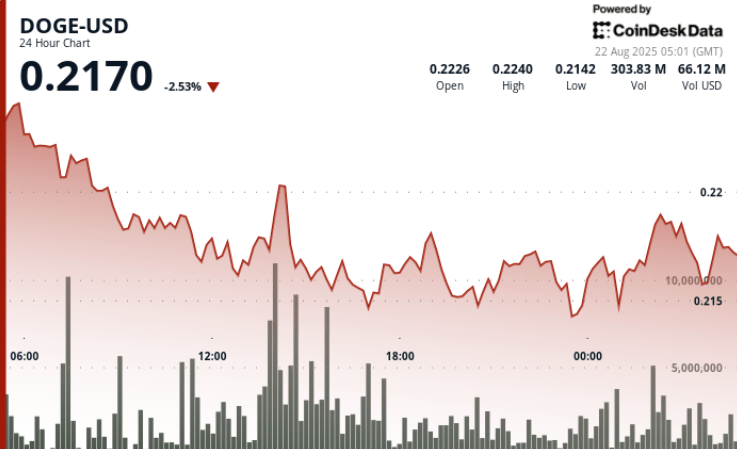

Summary of the price action

• Doge quoted in a $ 0.01 band from $ 0.21 to $ 0.22 between August 20, 15:00 and August 21, 14:00, marking ~ 4–5% of intradic volatility.

• Token recovered from 5% of $ 0.21 to $ 0.22 during the afternoon session of August 20, establishing $ 0.22 as a short -term resistance.

• A 60 -minute tarded window (August 21, 22–14: 21) saw an increase in Dux that 1% of $ 0.22 to $ 0.22 with volume peaks greater than 61.8 million, confirming the institutional activity.

• The support was constantly maintained in the $ 0.21– $ 0.22 area with rebounds in a volume of 320–380 million in the key test points.

Technical analysis

• Support: $ 0.21– $ 0.22 established as a reliable floor with repeated high volume reestimations.

• Endurance: $ 0.22 clear key pivot, but bulls need tracking towards $ 0.225 to confirm the rupture.

• Volume: The maximum increase of 61.8 million and 378.6 million confirm the institutional purchase interest.

• Pattern: Classical consolidation followed by an impulsive break; Ascending trajectory if the support base is maintained.

• Futures of: Stable around $ 3 billion, reflecting sustained leverage interest despite the macro volatility.

What merchants are seeing

• If Doge can be kept above the $ 0.22 pivot and push to $ 0.225– $ 0.23 resistance.

• Market reaction to fed policy changes and the launch of Wyoming Stablecoin: possible tail wind throughout the sector.

• Whale accumulation patterns, which already total 2 billion dux ($ 500 million) this week.

• Expansion of the mining sector through the acquisition of THUMZUP and its impact on the distribution of Doge power.