Dogecoin increased to $ 0.27 by more than 1.1b in rotation, with whale wallets adding 30 my tokens to speculation increased the potential inclusion of the retirement fund. The support has changed higher in the $ 0.27 area as the institutions pressed offers, with an impulse that now looks at the $ 0.30 ceiling.

News history

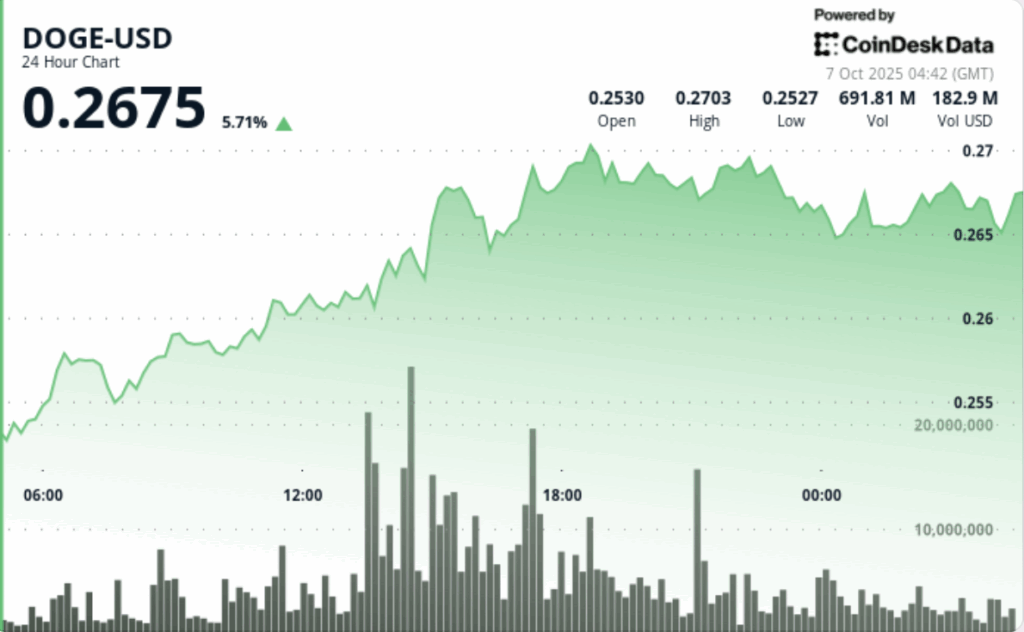

Doge increased 6% between October 6, 04:00 and October 7, 03:00, rising from $ 0.25 to $ 0.27. The rally was backed by heavy accumulation flows (medium level and large holders add more than 30 m tokens, and exchange equivalent outputs to $ 25 million. The market talk indicated the probabilities of approval of the sec for eligibility 401 (K), reflecting bitcoin and the retirement integration of Ethereum. Analysts marked ascending triangle formations and cyclic signs aimed at $ 0.30– $ 0.35.

Summary of the price action

- Dege traded a 7% band between $ 0.25 and $ 0.27.

- The accelerated rupture during the window of 14: 00–15: 00 in tokens 1.15b, the highest rotation in weeks.

- The price exceeded $ 0.27 until the afternoon, where a new resistance arose.

- The final session saw a consolidation of around $ 0.27 with decreasing volumes, seen as the taking of profits instead of structural weakness.

Technical analysis

The support has increased up to $ 0.27 after multiple defenses, while the resistance is firm to $ 0.27– $ 0.30. The structure of the graph reflects an ascending triangle, with higher minimums pressing towards the ceiling. Analysts also highlight a 42 -day cyclical signal that is aligned with the breakup attempt. Sustained closures are required above $ 0.27 to confirm the impulse to the area of $ 0.30 – $ 0.35.

What operators are seeing?

- If Dege can turn $ 0.27 on a durable support.

- A break through $ 0.30 to validate technical objectives in the $ 0.32– $ 0.35 zone.

- Confirmation of the accumulation led by whales as the exchange exits tight the supply.

- Possible regulatory holders on the eligibility of the retirement fund that drives conventional flows.