The meme currency pushes through the resistance to the accumulation of billions of Token before the backward cuts of the late session.

General description of the technical analysis

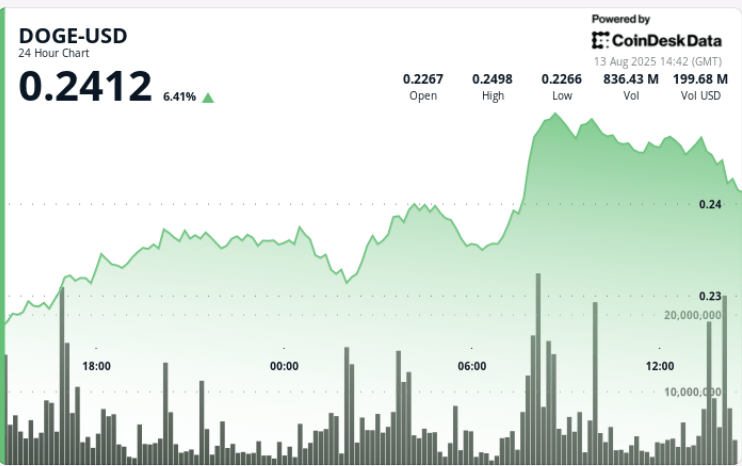

Doge rises 6.5% in the 23 -hour period ending on August 13, 14:00, moving from $ 0.23 to $ 0.24 in a range of $ 0.02 (9.58% volatility). Early trade confirms $ 0.23 as a key support in the volume higher than the average, while the resistance in half of the session between 07: 00-08: 00 sends the price through multiple levels of resistance in the volume of 1.56b, the largest printing of the day, indicating the coordinated institutional accumulation.

Price stops about $ 0.25 as blows to obtain profits, limiting the break. The support changes more to $ 0.24 after multiple successful reestimations at closing.

News history

The accumulation of whales exceeded 1b Doge (~ $ 200 million) during the rally, raising the property of the large holders about half of the circulating offer. The increase is aligned with the technical configurations in the daily lists, including a breakdown of the bull flag and an emerging golden cross, with objectives of patterns that point to the area of $ 0.30.

Summary of the price action

• Doge earns 7% of $ 0.23 to $ 0.24 during August 12, 15: 00 – August 13, 14:00

• 07: 00-08: 00 Breakout in the volume of 1.56B deletes multiple levels of resistance

• The price reaches its maximum point of about $ 0.25 before returning over $ 0.24 in the outlook

• The $ 0.24 support remains in the repeated late session tests

Market analysis and economic factors

The combination of whale entries and bullish graphics structures supported Doge’s impulse, although the supply of $ 0.25 remains a short -term limit. The consolidation above $ 0.24, together with the growing support levels, maintains the technical bias positive. The sustained institutional participation will be key for a break of $ 0.25 and an execution towards the technical objective of $ 0.30.

Analysis of technical indicators

• Support: $ 0.23 (early defense), $ 0.24 (late session floor)

• Resistance: $ 0.25 (profit taking)

• Volume: 1.56b during the time of rupture; Daily average 565.8m

• Breakout of the bull flag with a golden cross forming in daily graphics

• The highest minimums indicate a trend of persistent accumulation

What merchants are seeing

• Confirmation of rupture above $ 0.25 to open the road to the aim of $ 0.30

• $ 0.24 force in any earnings

• Continuation of large holders accumulation trends

• Impact of the broader feeling of the market on meme coin flows