Meme Coin dege extended its slide on Monday, falling through support levels and causing a fresh sales interest as the broader market risk appetite collapsed.

What to know

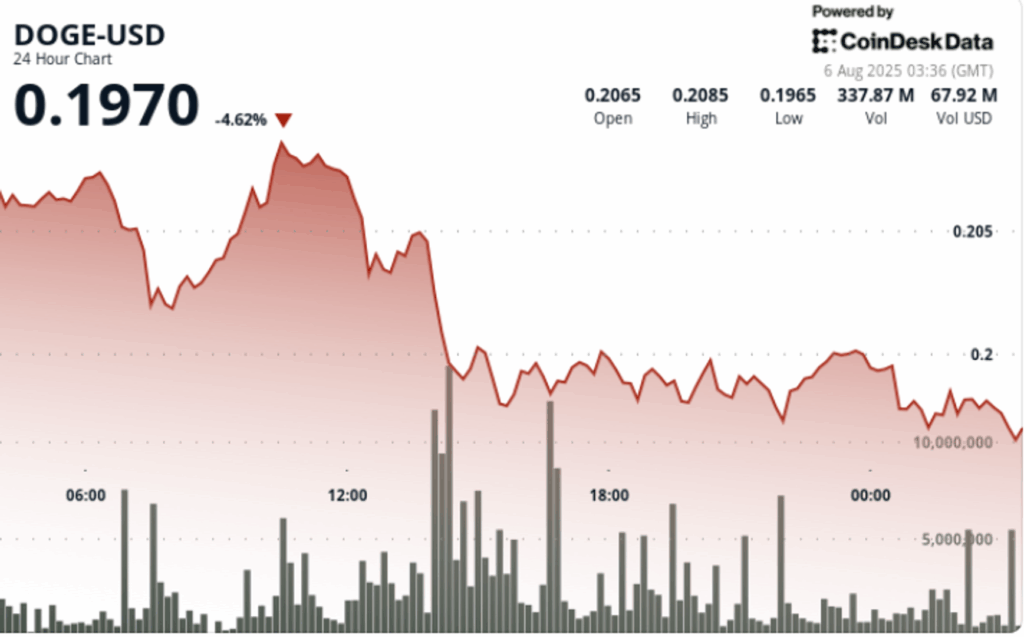

Dogecoin fell 5% during the 24 -hour session from August 4 at 9:00 p.m. to 20:00, decreasing from $ 0.21 to $ 0.20. The Token quoted within a range of $ 0.013, with minimums of $ 0.198 and maximums of $ 0.211. There was a key liquidation event during the 2:00 p.m. on August 5, with volumes that reach 877.9 million, almost 4 times the average of 24 hours of 268.85 million, which caused a breakdown below $ 0.205.

Dege finished the session at $ 0.1985 after not recovering higher resistance areas, pointing out the institutional sale and confirming the new downward impulse. The measure is produced in the midst of a broader weakness of the cryptographic market caused by the feeling of risk in global actions.

News history

Doge’s decline coincided with the institutional outputs of ETFs linked to cryptography for a total of $ 223 million during last week, according to Coinshares data. The Federal Reserve housing and renewed geopolitical concerns, including retaliation rates and basic product flow interruptions, have fed risk aversion in traditional and cryptographic markets.

At the same time, the meme coins sector remains under pressure as the retail enthusiasm fades and the great headlines continue to turn in Altcoins or cash positions of greater cash. Dege had previously shown signs of accumulation last week, but the fact of not maintaining the level of $ 0.205 invalidated the configuration.

Summary of the price action

Doge started the strong session, reaching $ 0.211 at 01:00, but was invested sharply during the day. The most steep decrease occurred at 14:00, when the price fell from $ 0.205 to $ 0.199 in the middle of 877.9 million in volume. At 19:51, another rinse at $ 0.1975 occurred in a volume of 19.04 million, more than 70 times the average per hour, before a shallow rebound at $ 0.1985 at the closure.

The new resistance has formed about $ 0.205, and Price cannot maintain any recovery above that level after breakdown. The token currently quotes near the minimums of the session and does not show confirmation of an investment.

Technical analysis

- Doge quoted within a range of 6% between $ 0.198 and $ 0.211

- Volume increased to 877.9 million at 14:00, almost 4 times above the daily average

- Rejection of $ 0.205 triggered the breakdown of the session

- Support tried $ 0.198- $ 0.199, but the volume in Bunce remained weak

- The final time saw the volume of 19.04m at the level of $ 0.1975, creating local resistance at $ 0.1988

- The impulse remains in the inconvenience unless the price recovers $ 0.205 in convincing volume

What merchants are seeing

Merchants are watching closely if Dege can stabilize above $ 0.198 or face around $ 0.185. The lack of recovery above $ 0.205 can extend liquidations. With volumes that shoot in the movements down and fader in the recoveries, the sellers continue to control unless the macro risk feeling improves or the ETF outputs are revised.