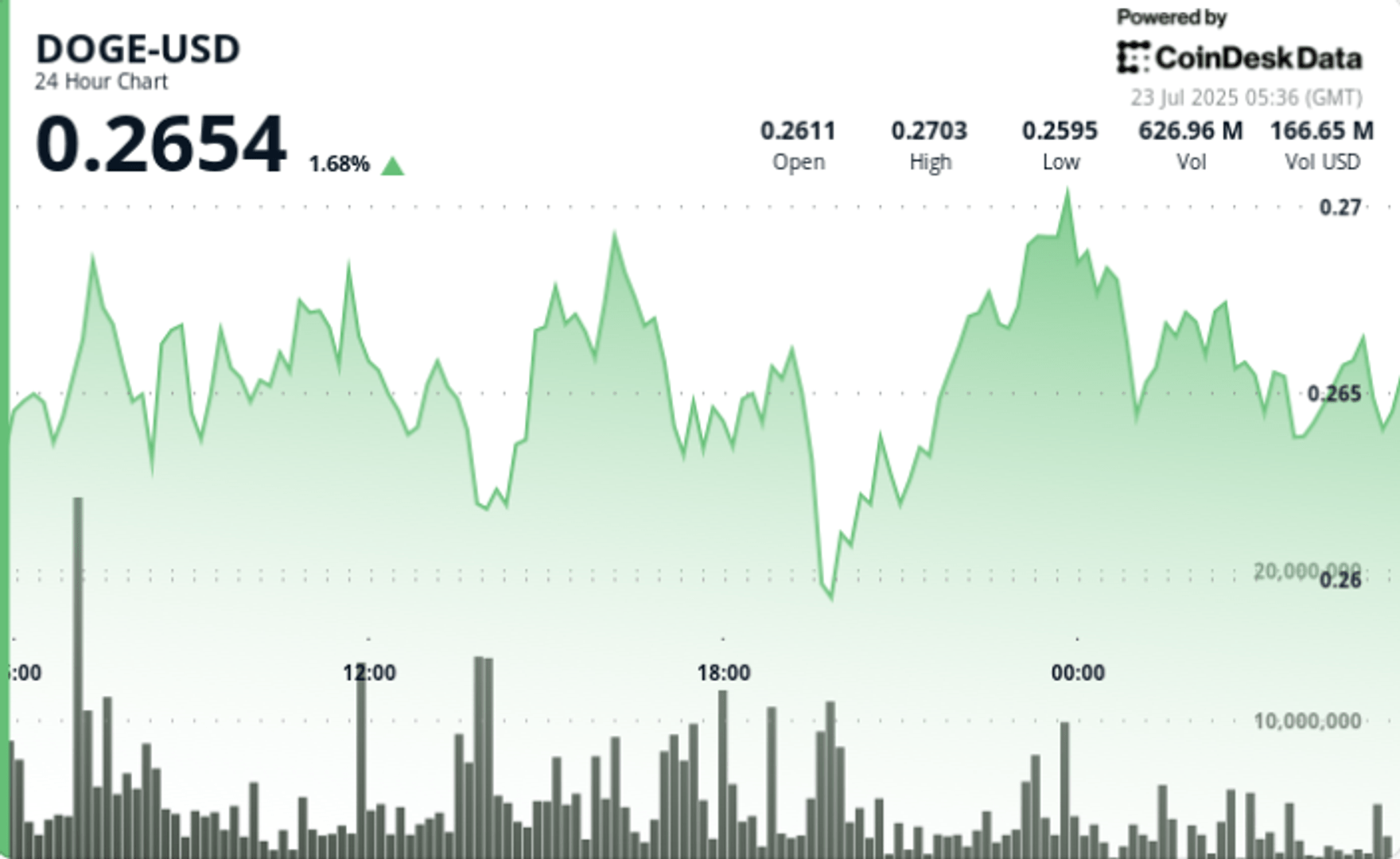

Dogecoin recovered sharply against the macro global uncertainty, climbing 5% during the 24 -hour session that ended on July 23 at 05:00 GMT. The movement occurred when the increased geopolitical tensions fed risk volatility, but Dege showed resilience with strong intradic recoveries and support reestimations backed by volume that attracted a renewed interest of tactical merchants.

What to know

• Doge quoted in an adjustment of $ 0.01 between $ 0.26 and $ 0.27, which represents a 5% differential during the July 22 session at 06:00 and July 23 at 05:00 GMT.

• The volume reached 720.64 million and 717.84 million during key investment windows, almost 75% above the 24 -hour average of 408.52 million.

• The final negotiation time saw Doge Spike at $ 0.27 before being $ 0.26 again in an explosion of a single minute of 10.47 million at 05:06 GMT.

• The technical indicators suggest consolidation around $ 0.26– $ 0.27, with support established in lower bands despite the winning of the final session.

News history

Doge’s price action is produced in the midst of the large -grass -based -based criptomonets market linked to macroeconomic uncertainty, including renewed commercial restrictions in Asia and fluctuating feeling in risk assets. The meme currency has recently become a Proxy of high beta crypto bets, with institutional trade desks that indicate an increase in volume -based strategies as punctual volatility is normalized.

Summary of the price action

Dege registered an initial decrease towards $ 0.26 around 19:00 GMT before organizing a complete setback at $ 0.27 for 23:00 GMT. The most notable investment took place in the last 60 minutes, with Doge constantly rising before the acute sales pressure overwhelms the movement, returning the asset to the support levels at $ 0.26. The recovery demonstrated a clear short -term accumulation behavior, but lacked resistance monitoring.

Technical analysis

• Intradía range: $ 0.26– $ 0.27 (5% swing).

• Intraday under formed around 19:00 GMT, recovery at $ 0.27 per 23:00 GMT.

• Confirmed resistance at $ 0.27 with rejection in the midst of volume peaks.

• The support remained several times about $ 0.26, with high volume candles.

• The final time saw a pronounced reversal driven by the volume followed by the profits.

• The single minute volume reached 10.47 million at 05:06 GMT, coinciding with a strong drop of $ 0.01.

• RSI shows a neutral zone; MacD Flatlining after recent crossover.

What merchants are seeing

• Can Dege consolidate above $ 0.26 in the next 12–24 hours, or the sellers will try $ 0.25 again?

• Merchants are observing signs of resistance rupture at $ 0.27, which has remained firm despite the intradicist activity.

• Be aware of a follow -up volume greater than 750 million to confirm the continuation of the impulse.

• A movement below $ 0.256 could activate $ 0.24 levels.

(Discharge of responsibility: parts of this article were generated with the assistance of the AI tools and reviewed by our editorial team to guarantee the accuracy and fulfillment of our standards. For more information, consult the complex policy of COINDESK).