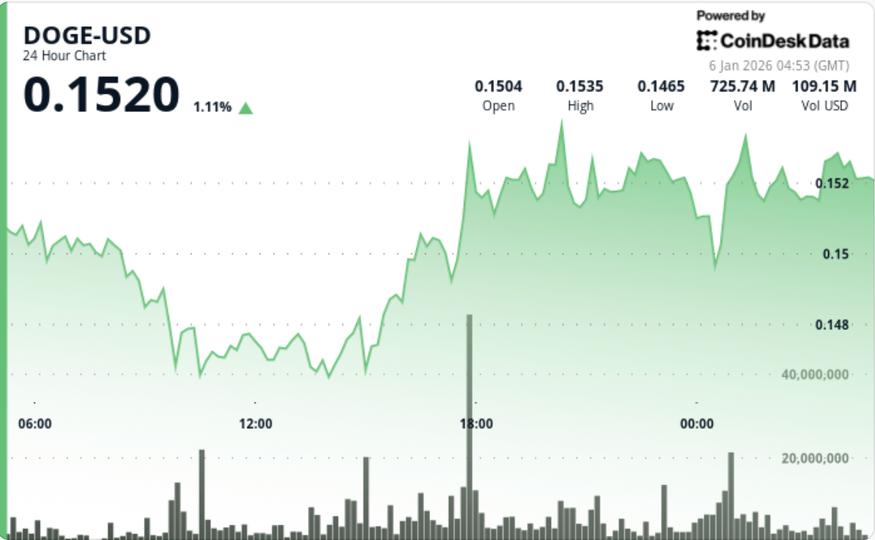

DOGE held near $0.152 after recovering sharply from a low of $0.146, with the move supported by a burst of above-average volume, and landing as leveraged “meme beta” trading draws new attention after Bloomberg ETF analyst Eric Balchunas noted that a 2x Dogecoin ETF is among the best-performing ETFs to start the year.

News background

Meme coins have been the market’s temperature check early in the year, with DOGE and PEPE leading a strong rebound as traders leaned toward “meme season” narratives amid still uneven liquidity. CoinGecko’s GMCI Meme Index has shown the category is heating up, while a broader “dog-themed” basket also traded higher alongside DOGE.

That context has also extended to ETFs. Balchunas said the best-performing ETFs to start the year include a 2x Dogecoin ETF and a 2x Single-Stock Semiconductor ETF, underscoring that “higher beta” expressions of risk appetite are leading flows early in the year. Traders typically treat that type of leaderboard as a sentiment signal, not a fundamental factor, but it often reinforces momentum in the underlying when positioning is already saturated.

The broader macro setup remains important: bitcoin has remained relatively range-bound, and when big companies stagnate, speculative flows tend to spill into meme coins because they move quickly, have liquid derivatives markets, and don’t require a macro catalyst to trade.

Technical analysis

DOGE was effectively flat on the day ($0.1518 to $0.1519), but the headline is the structure: a V-shaped recovery that began after a sharp rise to $0.1461 (Jan 5, 09:00) and reversed aggressively into the US afternoon.

The recovery phase (16:00-17:00) came with a clear volume signature: ~880 million-886 million tokens traded, approximately 87% above the 24-hour average, as the price rose to the mid-$0.15 and touched $0.1536. That’s the kind of “participation control” that technicians are looking for: the rally was not a smooth process; was greeted with royal offers.

From there, DOGE moved into consolidation and began to show some short-term corrective pressure. In the last hour, the price fell from $0.1526 to $0.1523, testing the support of $0.1513, while during the decline a peak of 26.9 million was printed (roughly triple the hourly norm). Importantly, follow-on sales did not increase after that spike, and DOGE recovered towards $0.1519, suggesting that the market is still willing to defend the $0.151-$0.152 level.

Technically, this is now a classic post-recovery setup: a sharp recovery, then a tight range, with $0.1540-0.1543 acting as the immediate limit and $0.1461 as the key “if it breaks, the pattern changes” reference point.

Price Action Summary

- DOGE completed a V-shaped recovery after falling to $0.1461

- The rebound leg was confirmed with above-average volume of ~87% during the 16:00-17:00 push.

- The price marked $0.1536 before consolidating again near $0.152

- Late selling tested the support at $0.1513, but the bounce held until the close.

What traders should know

This is now a range trade around a new inflection point and the levels are clear:

- If $0.1513 holds: DOGE can continue to digest gains above $0.15 and prepare another attempt between $0.1540 and $0.1543. A clear break there opens the door for an extension of momentum towards the next pockets of resistance (higher fiber levels) and usually attracts trend-following flows.

- If $0.1513 level is broken: The V-shaped recovery risks turning into a broader pullback, with sights set on $0.1461 again. A loss of $0.146 would weaken the “reversal” reading and reopen the previous demand zone.

- Why the ETF Note Matters: Balchunas’ observation of a 2x DOGE ETF leading ETF performance earlier in the year doesn’t change the fundamentals of DOGE, but it does reinforce the same message coming from the tape: risk appetite is expressed through high-beta vehicles, and meme coins are one of the cleanest substitutes for that behavior.