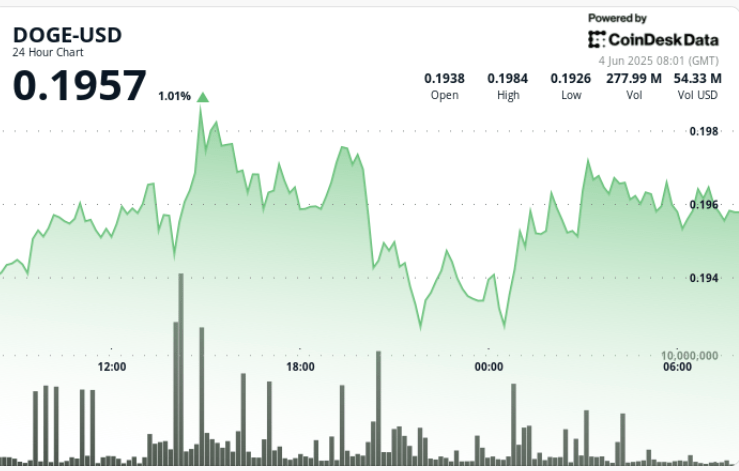

Dogecoin (Doge) increased 2.4% in the last 24 hours, rising from $ 0.192 to $ 0.197, since institutional buyers seemed to intervene amid global economic uncertainty.

The rupture of the Token above the resistance level of $ 0.194 highlights the renewed trust in the potential of the meme currency as coverage against a broader market volatility.

The increase was accompanied by a Dux transfer from $ 20 million to Coinbase, pointing out the possible movements of the main market movements.

News history

- The recent increase in Dogecoin occurs in the midst of a renewed interest in memes currencies and changing institutional dynamics.

- A Doge transfer from $ 20 million to Coinbase has generated speculation about the accumulation of whales or institutional.

- The growing activity in the chain and the main tokens transfers highlight the liquidity of Doge and the potential institutional attraction, even when the broader markets remain unsolved.

Price action

The technical analysis shows doge in a clear superior trend, with significant volume peaks at 01:00 (470m) and 14:00 (386m) confirming the buds above the key resistance levels.

The support has been formed at $ 0.194, with the $ 0.198- $ 0.200 area that now represents the next critical resistance. A break above this level could open the door to obtain more profits towards $ 0.205.

In the last hour of trade, Dege maintained its bullish impulse, with a break at 7:28 PMs that push the prices of $ 0.197 to $ 0.198 in an exceptional volume of 10.17 million units. The new support level at $ 0.197, together with a low level pattern, suggests a continuous accumulation and a more upward potential.

Technical Analysis Summary

- Doge rose from $ 0.192 to $ 0.197, a gain of 2.44% in 24 hours.

- The price action showed a range of $ 0.008 (4.16%), reflecting moderate volatility.

- Key support established at $ 0.194, with resistance at $ 0.198- $ 0.200.

- The volume peaks at 01:00 (470m) and 14:00 (386m) confirmed bullish outbreaks.

- Breakout per notable hour at 7:28 Prices exceeded $ 0.198 in a volume of 10.17m.

- Volatility per hour was reduced to $ 0.001 (0.51%), which suggests consolidation.

- The greatest pattern indicates continuous accumulation and possible resistance test of $ 0.198.