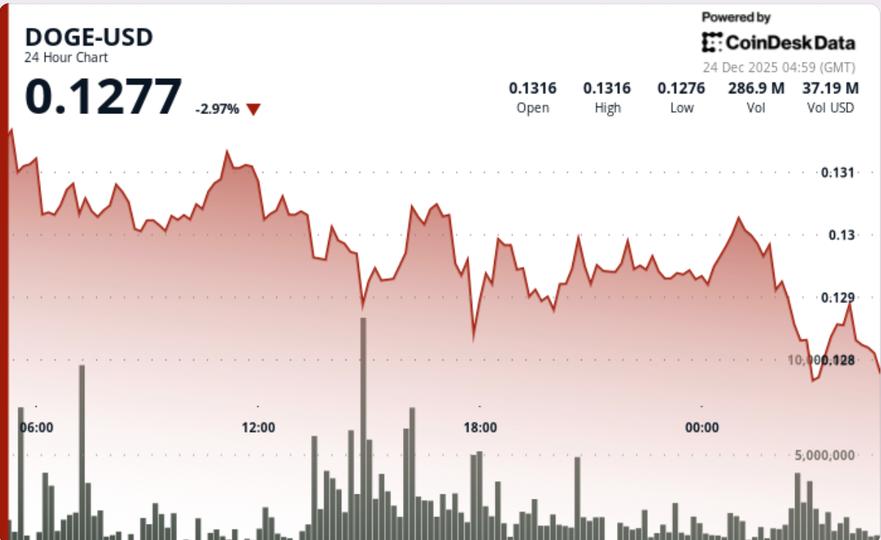

Dogecoin fell below the $0.13 level on Tuesday as heavy spot selling coincided with a sharp rise in derivatives activity, suggesting traders are positioning for broader swings rather than an immediate rebound.

News background

BitMEX reported that Dogecoin futures volume rose 53,000% to $260 million as traders increased exposure to the move, a sign that volatility expectations are rising even as the spot price weakens. The burst in derivatives rotation came alongside a sharp spot sell-off that pushed DOGE through the psychological floor of $0.13, keeping the meme-coin complex under pressure while broader crypto markets remained uneven.

The surge in futures activity also comes as traders continue to use meme coins as expressions of high-beta sentiment, making DOGE more sensitive to positioning changes and liquidity pockets than many large-cap tokens. That dynamic tends to amplify moves once key levels are broken, particularly around round number supports like $0.13.

Technical analysis

DOGE broke below $0.1300 after sellers pressured the market during US hours, with the key confirmation coming at 16:00 on December 23, when volume reached 639 million tokens, about 101% above the session average. That spike marked a clear change in flow: buyers who had previously defended $0.13 retreated and the level moved from support to general supply.

On the intraday chart, sales picked up again around 01:41, with the price breaking through the provisional supports at $0.1295 and $0.1292. The structure now resembles a descending channel, with DOGE leaning towards the lower boundary while trading below the short-term moving averages. That usually keeps rallies shallow until the market can recover the broken pivot.

Price Action Summary

- DOGE fell 2.3% from $0.1323 to $0.1292 in 24 hours

- The $0.1300 floor was broken with the highest spot volume of the session.

- The price stabilized near $0.1290 late as volume cooled sharply from high levels.

- The intraday range widened to $0.0047 (about 3.6%), indicating increasing volatility.

What traders should know

$0.13 is now the level that matters. If DOGE can recover and hold it, the move looks more like a wash and reset and could trigger a short covering bounce towards $0.1320. If it fails to recover $0.13, the market is likely to probe the next demand group around $0.1285-0.1280, where buyers may attempt another defense.

The huge jump in futures volume suggests that traders are preparing for continued volatility rather than a quiet drift. That can go both ways: it increases the odds of strong pullbacks, but it also means breakouts can extend quickly if stops are triggered below $0.1290 and liquidity dwindles.